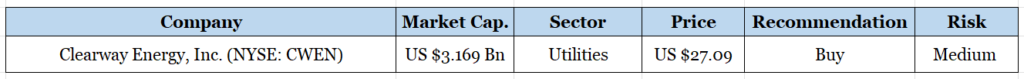

Clearway Energy, Inc. (NYSE: CWEN) : Leading U.S. renewable energy stock for long-term investing

Clearway Energy, Inc. (NYSE: CWEN) is a leading renewable energy company based in the United States. Formerly known as NRG Yield, Inc., it changed its name to Clearway Energy in 2018. The company owns and operates a diversified portfolio of renewable energy assets, including wind, solar, and natural gas-fired power generation facilities.

Clearway Energy focuses on developing and acquiring clean energy projects across North America. Its portfolio includes both utility-scale and distributed generation assets, serving various customers, including utilities, corporations, and communities. The company’s goal is to contribute to the transition to a more sustainable energy future by providing reliable, affordable, and environmentally friendly power solutions.

Clearway Energy is known for its commitment to sustainability and innovation in the renewable energy sector. It continues to expand its portfolio through strategic investments and partnerships while maintaining a strong focus on operational excellence and environmental stewardship.

Highlights and News Updates

- On May 1st, 2024, Clearway Energy named Cornelius as the Next CEO as Sotos Steps Down.

- On November 28th, 2023, Carlyle Group’s Shares Rise as Company to Replace ICU Medical in the S&P MidCap 400 Index.

- On November 28th, 2023, Clearway Energy surges on S&P SmallCap addition.

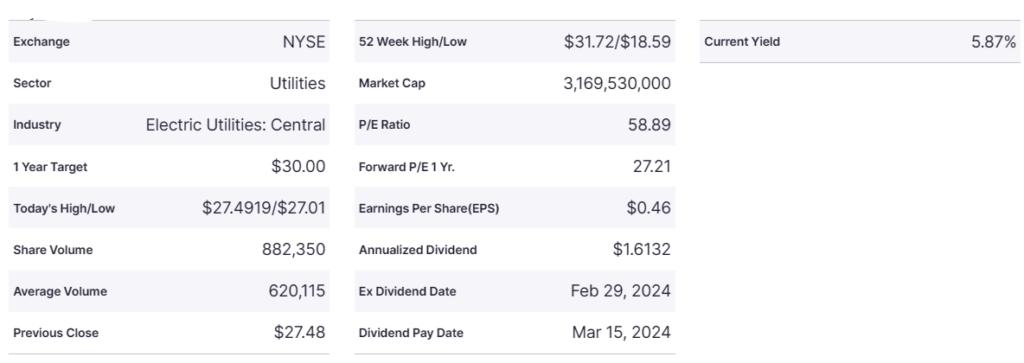

Key Data

First Quarter 2024 Highlights

- Total revenues of US $263 million declined by 8.7% from the year-ago quarter’s figure of US $288 million.

- Adjusted EBITDA for the quarter totaled US $211 million compared with US $218 million in the year-ago period.

- The company signed agreements with Clearway Group to commit to invest in 55-megawatt (MW) of wind and 257 MW of solar plus storage projects.

- On May 6, 2024, CWEN contracted with a load-serving entity to sell approximately 97 MW of Resource Adequacy, commencing in January 2027, and ending in December 2027.

- Total operating costs and expenses for the quarter amounted to US $292 million, up 18.7% from the year-ago quarter’s figure of US $246 million. This was due to an increase in the cost of operations and higher depreciation, amortization, and accretion costs.

- The operating loss for the quarter came in at US $29 million against the year-ago quarter’s income of US $42 million.

- CWEN incurred interest expenses of US $57 million compared with US $99 million in the year-ago quarter.

Financials

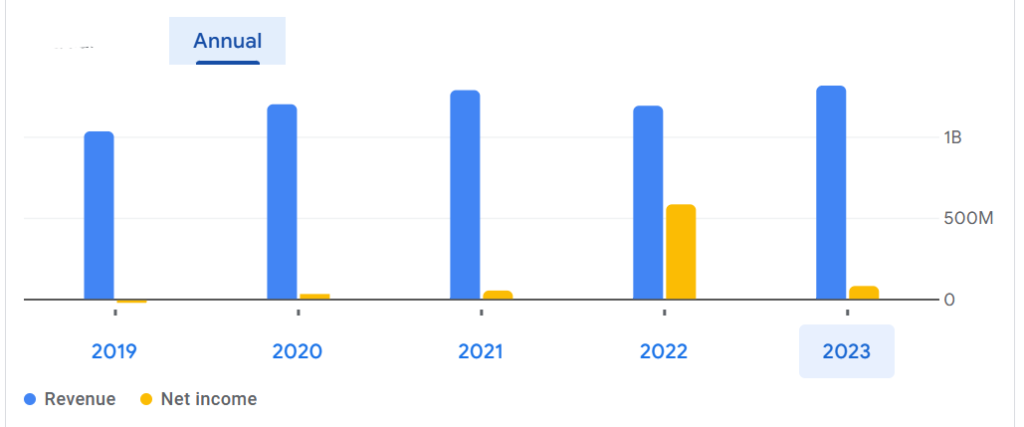

Clearway Energy, Inc.’s financial performance over the past four years showcases both stability and fluctuations. Revenue experienced minor ups and downs, reaching its peak in 2023 at US $1.314 billion. Despite rising revenue, costs also increased, with the cost of revenue hitting US $473 million in 2023. However, Clearway managed to maintain stable gross profit, indicating efficient cost management strategies, with a peak of US $841 million in 2023. Operating income varied notably, reaching a high of US $1.47 billion in 2022.

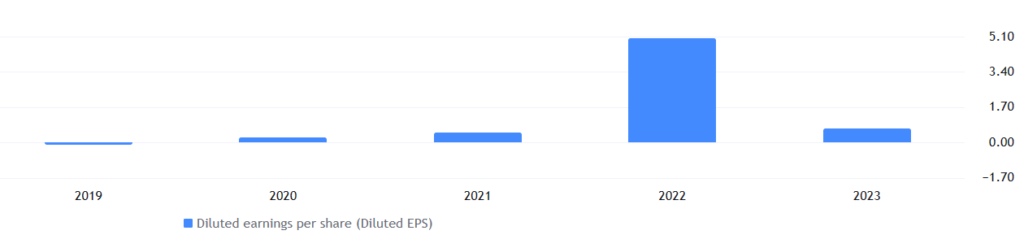

Interest expenses fluctuated, impacting profitability, with a peak of US $415 million in 2020. Net income showed variations but remained consistent for common shareholders, peaking at US $582 million in 2022. Overall, Clearway’s ability to navigate these fluctuations reflects resilience amidst market changes, underscoring the importance of effective cost management and revenue diversification for sustained growth.

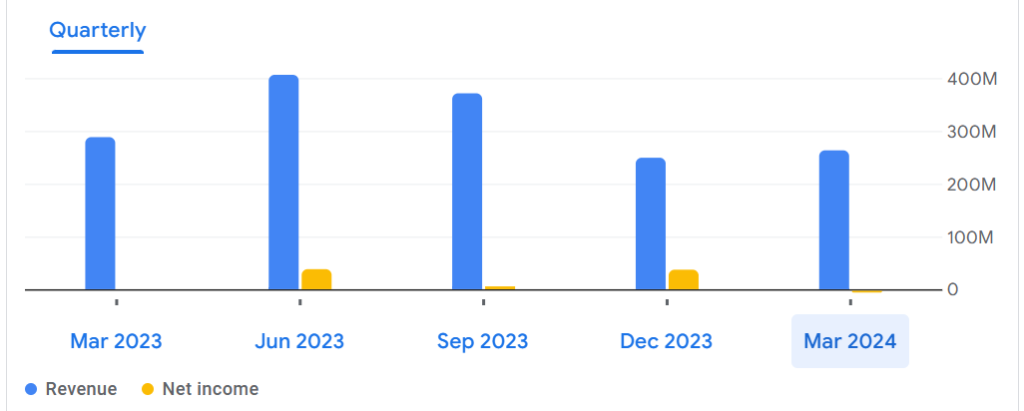

Clearway Energy, Inc.’s quarterly financial data reveals fluctuations and trends over the specified periods. In terms of revenue, there were variations quarter by quarter, with the highest reported in Q3 2023 at US $371 million and the lowest in Q1 2024 at US $263 million. Cost of revenue fluctuated as well, peaking in Q4 2023 at US $113 million and reaching its lowest in Q1 2024 at US $126 million. Gross profit mirrored revenue trends, with the highest reported in Q3 2023 at US $237 million and the lowest in Q1 2024 at US $137 million.

Operating expenses, including sales, general and administrative expenses, remained relatively stable across the quarters, with minor fluctuations. Operating income varied significantly, with Q3 2023 reporting the highest at US $94 million and Q1 2024 reporting the lowest at US -$29 million. Interest expenses fluctuated as well, peaking in Q4 2023 at US $135 million and reaching the lowest in Q2 2023 at US $48 million. Net income showed variability, with Q4 2023 reporting the highest at US $37 million and Q1 2024 reporting a slight loss of US $-2 million.

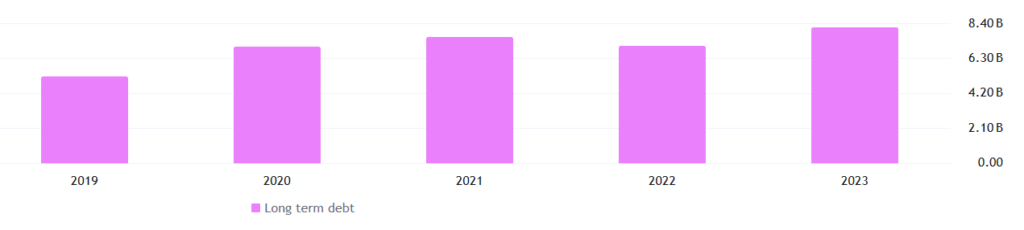

Clearway Energy, Inc. exhibits a complex financial picture, as evidenced by its substantial debt load of US $8.369 billion. However, the company’s assets, totaling US $14.70 billion, offer a significant buffer against this debt burden, potentially safeguarding its financial stability. Moreover, Clearway’s liquidity is bolstered by cash reserves of US $1.05 billion, providing flexibility in meeting short-term obligations and pursuing growth initiatives. Additionally, the company maintains a capital surplus of US $361 million, indicating an excess of funds beyond its immediate capital requirements. While the capital surplus enhances Clearway’s financial resilience, effective debt management strategies will be crucial in optimizing its financial position and mitigating risks associated with high debt levels. Balancing debt reduction efforts with strategic investments and operational efficiency will be essential for Clearway to navigate the complexities of the energy market landscape and sustain long-term growth.

Right now, the EPS of the company is at US $0.68 compared to US $4.97 last year.

Forecast

Right now, the company is trading at US $27.09 with a 1-year projected target of around US $31 and a low estimation of US $24.20; the average price target is US $29.36. The recommended buying range will be US $26.50-US $24.30.

Technical Analysis

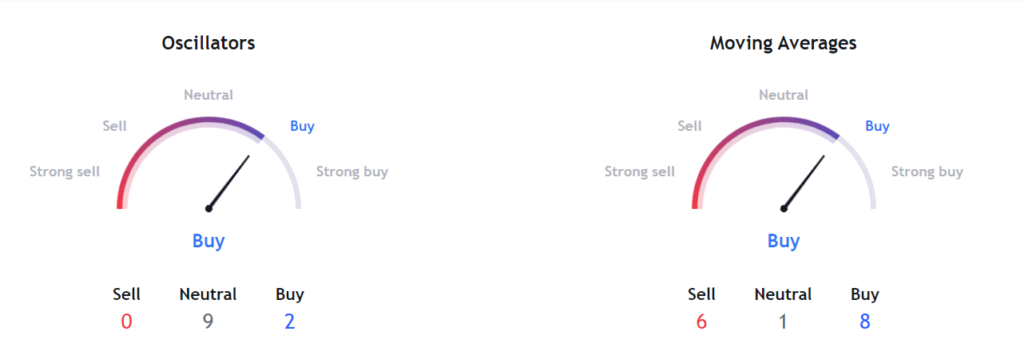

- The stock has corrected around 2% and it is expected to correct more, and the stock is also trading in a range.

- Right now, the RSI (46.57) indicator is below 50, and it is also giving us a bullish divergence.

- The stock has the potential to bounce back up to 8%-13% from the current market price. Analysts are bullish on this stock.

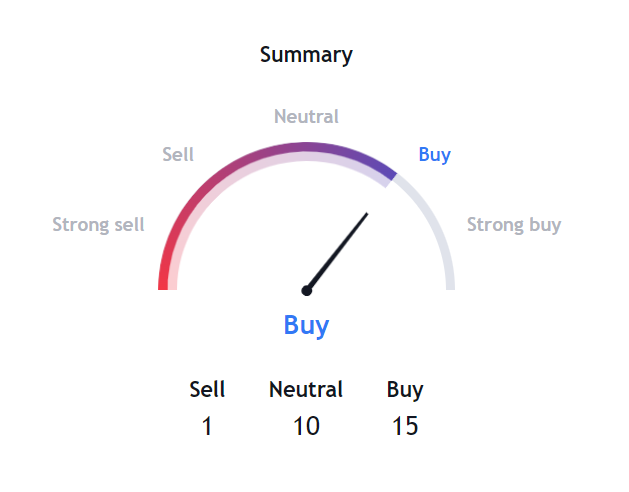

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Market sentiments are bullish on the stock over the long term.

- MACD (1.16) indicator is giving a bullish signal.

- VWAP (24.84) indicator is bullish on the stock.

Risk factors

Several risks are associated with Clearway Energy, Inc., which investors and stakeholders should consider:

- Clearway’s operations are subject to regulatory changes in the renewable energy sector, including policies related to subsidies, tax incentives, and environmental regulations. Shifts in government policies or regulatory uncertainty could impact Clearway’s revenue streams and profitability.

- The energy market is prone to volatility due to factors such as changes in commodity prices, supply and demand dynamics, and geopolitical events. Fluctuations in energy prices could affect Clearway’s financial performance and project economics.

- Clearway’s substantial debt load exposes it to interest rate risk. Rising interest rates could increase the company’s borrowing costs, negatively impacting its profitability and cash flow.

- Clearway’s renewable energy projects involve various risks, including construction delays, cost overruns, and performance uncertainties. Project delays or underperformance could lead to revenue shortfalls and financial losses.

- Rapid technological advancements and innovations in the renewable energy sector pose both opportunities and risks for Clearway. Failure to adapt to technological changes or capitalize on emerging trends could hinder the company’s competitiveness and growth prospects.

- Clearway faces competition from other renewable energy developers, utilities, and traditional energy companies. Intense competition could pressure Clearway’s pricing, market share, and profitability.

- Clearway’s operations are influenced by environmental factors such as weather conditions, natural disasters, and climate change. Extreme weather events or environmental disruptions could disrupt operations and impact asset performance.

Stock Recommendation

Clearway Energy, Inc. presents a compelling investment opportunity for several reasons. Firstly, it operates in the rapidly growing renewable energy sector, aligning with global sustainability trends. Secondly, its diversified portfolio of renewable energy assets across North America ensures revenue stability. Thirdly, Clearway’s strong financial profile, including significant assets, cash reserves, and capital surplus, provides financial resilience and flexibility. Additionally, the company’s operational excellence, technological innovation, and commitment to sustainability enhance its competitiveness. Finally, with an experienced management team and strategic vision, Clearway is poised for sustainable long-term growth and value creation in the renewable energy industry.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $27.09 as of May 16th, 2024. The recommended buying range will be US $26.50-US $24.30.

| CMP (US) (May 16, 2024) | $27.09 |

| Target Price | $31 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.