Consolidated Water Co. Ltd. (NASDAQ: CWCO) – A leader in seawater desalination, providing vital solutions worldwide

Consolidated Water Co. Ltd. (NASDAQ: CWCO) is a publicly traded company that specializes in the development and operation of seawater desalination plants and water distribution systems. The company primarily focuses on providing potable (drinking) water to areas where freshwater resources are scarce or limited. Consolidated Water was founded in 1973 and is headquartered in George Town, Grand Cayman, in the Cayman Islands. The company operates in various regions, including the Caribbean, the Middle East, and other parts of the world where water scarcity is a concern.

One of the notable aspects of Consolidated Water is its commitment to utilizing environmentally sustainable practices in its water desalination processes. The company aims to minimize its environmental impact while efficiently providing clean drinking water to communities in need. Consolidated Water’s business model typically involves entering into long-term contracts with governments, municipalities, and private entities to provide water services. This model provides a steady revenue stream for the company while also ensuring reliable access to clean water for its customers.

Highlights and News Updates

- On April 6th, 2024, the stock’s performance was ahead of the S&P 500’s daily gain of 1.11%. At the same time, the Dow added 0.8%, and the tech-heavy Nasdaq gained 1.24%.

- On April 5th, 2024, Consolidated Water Co. Ltd. used the most advanced technology to convert seawater to potable water to meet customer needs, which boosted its financial performance. The company is also gaining from expanding operations via acquisitions and organic projects.

- On November 8th, 2023, Consolidated Water Keeps Quarterly Dividend at US $0.095 a Share, Payable Jan. 31 to Shareholders of Record on Jan. 2.

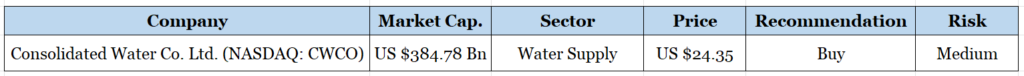

Key Data

Fourth Quarter 2023 Highlights

- The revenue of the company stood at US $53.25 million up by 87.32% compared to last year’s fourth quarter.

- The net earnings stood at US $9.84 million up by 542.53% compared to last year’s fourth quarter.

- The diluted EPS stood at US $0.62 up by 525.33% compared to last year’s fourth quarter.

- The COGS were at US $33.96 million which is also up 73.8% compared to last year’s fourth quarter.

Financials

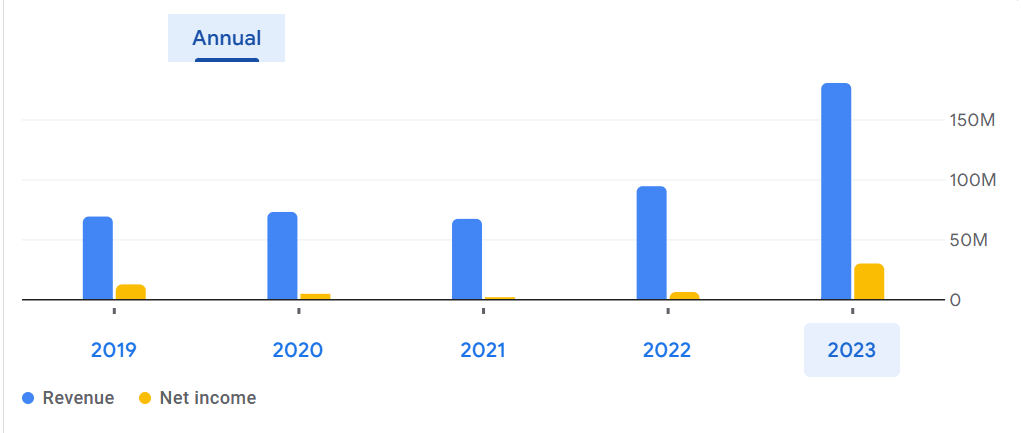

Consolidated Water Co. Ltd. exhibited remarkable financial performance from 2020 to 2023, marked by significant growth in total revenue, which surged from US $72.6 million to US $180.2 million. Despite this substantial increase, the company maintained a stable gross profit margin, indicating efficient cost management amidst expanding operations. Operating income saw a notable rise, demonstrating enhanced profitability and operational efficiency.

Net income experienced substantial growth, soaring from US $3.7 million in 2020 to US $29.6 million in 2023, showcasing strong bottom-line improvement. Although there were fluctuations in income tax expenses and additional income/expense items, overall profitability remained robust. The company’s ability to navigate challenges, maintain efficiency, and capitalize on growth opportunities underscores its resilience and potential for continued success in the water services industry.

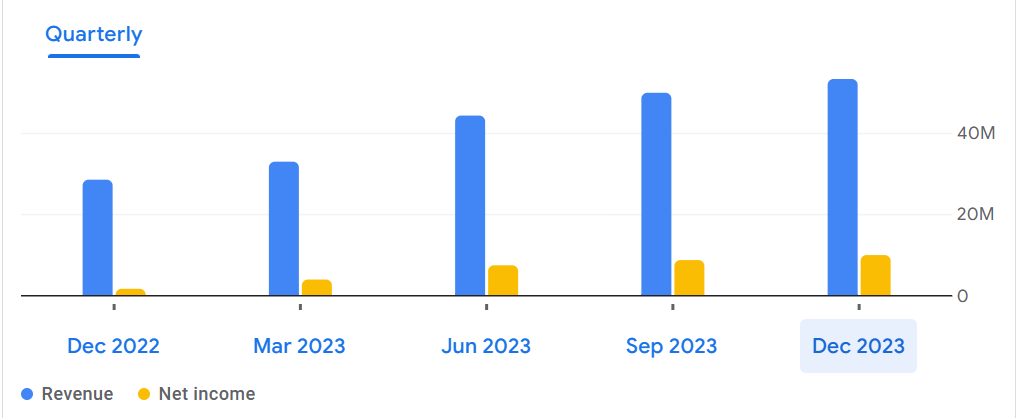

Consolidated Water Co. Ltd.’s quarterly financial data for 2023 reveals a pattern of growth and fluctuation in key metrics. Total revenue increased steadily throughout the year, starting at US $32.9 million in Q1 and reaching US $53.3 million by Q4. Similarly, the cost of revenue rose, indicating higher expenses associated with generating revenue. Despite these increased costs, gross profit also showed an upward trend, reflecting the company’s ability to maintain profitability.

Operating expenses, including sales, general, and administrative costs, remained relatively stable across the quarters. Non-recurring items fluctuated but had a minimal impact on overall performance. Operating income followed the revenue trend, increasing from US $4.5 million in Q1 to US $12.4 million in Q4. Earnings before interest and tax exhibited a similar pattern, reflecting the company’s operational efficiency and revenue growth.

Net income, both for continuing operations and overall, mirrored this trend, with Q4 showing the highest figures of US $10.2 million and US $9.8 million, respectively. Despite some fluctuations in income tax expenses and other items, Consolidated Water Co. Ltd. maintained a strong financial position throughout the year, indicating resilience and effective management amidst changing market conditions.

Consolidated Water Co. Ltd. has experienced significant growth in total debt over the past five years, rising from US $78.90 thousand in 2019 to US $383.00 thousand in 2023. However, the company’s assets have also grown, reaching US $219.57 million, with a substantial cash reserve of US $42.62 million and a capital surplus of US $85.149 million. The calculated debt-to-equity ratios show a steady increase over the years, indicating a higher level of financial leverage and potential risk for the company. While the increasing debt warrants attention but, the company’s strong asset base and cash reserves provide a cushion against financial strain.

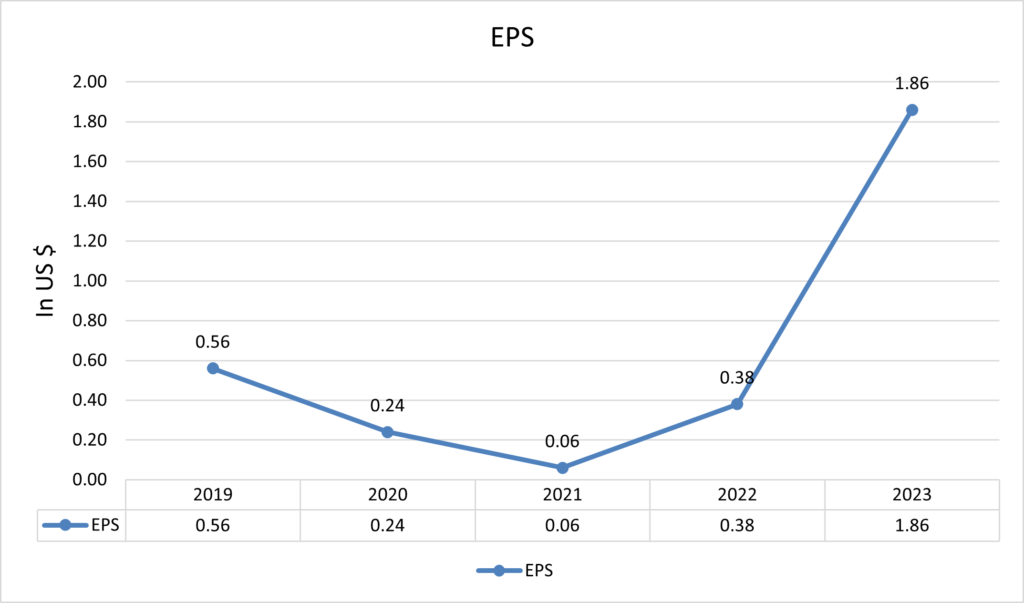

Currently, the EPS of the company is US $1.86 up by 391% compared to last year’s EPS.

Forecast

Right now, the company is trading at US $24.35. The recommended buy price will be around US $19-$18 with a 1-year projected target of around US $34 and a low estimation of US $17.65; the average price target is US $27 from the recommended price range.

Technical Analysis

- The stock has corrected more than 35% and it is expected to correct more.

- Right now, the RSI (28.73) indicator is below 50, and it tells us that the stock is trading cheaply.

- The stock has the potential to bounce back up to 40%-80% from the recommended price range. Analysts are bullish on this stock.

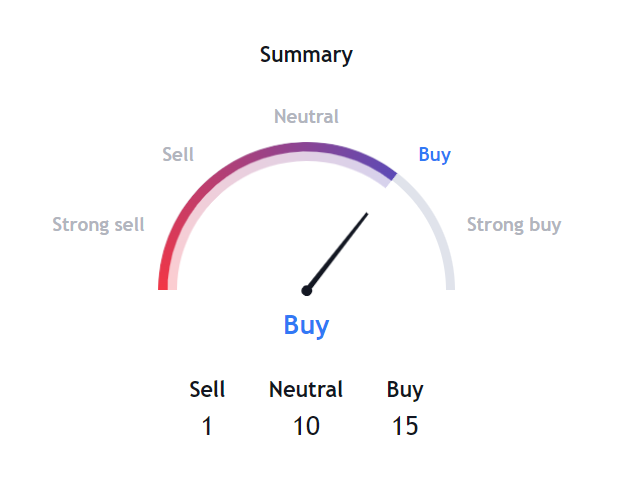

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock from the recommended price range.

- Market sentiments are bullish over the long term.

- The stock is trading very cheap.

Risk factors

Several risks could affect Consolidated Water Co. Ltd.’s operations and financial performance:

- Since Consolidated Water operates in various regions globally, fluctuations in currency exchange rates could affect its financial results when translating revenues and expenses into its reporting currency.

- Technical failures, operational disruptions, or accidents at desalination plants or water distribution systems could lead to production delays, increased costs, or damage to the company’s reputation.

- Environmental activism and public concerns over the ecological impact of desalination processes or wastewater disposal could lead to regulatory scrutiny, project delays, or reputational damage.

- The company’s expansion plans and the capital-intensive nature of its business may require significant investments in infrastructure and technology, which could strain its financial resources and increase debt levels.

Stock Recommendation

Consolidated Water Co. Ltd. excels in the water services industry thanks to its specialization in seawater desalination and sustainable water solutions. Its focused approach addresses crucial needs, particularly in water-scarce regions, while also appealing to environmentally conscious consumers. With a strong financial track record, including healthy assets, substantial cash reserves, and manageable debt, the company demonstrates sound financial management. Additionally, its global presence and diversified projects reduce risks and provide growth opportunities. Overall, Consolidated Water is recognized for its strategic focus, financial strength, and commitment to sustainability, making it a promising player in the industry.

MarketFacts gives a “Buy” rating on the stock at the recommended price range of US $19-18 as of April 10th, 2024.

| CMP (US) (April 10, 2024) | $24.35 |

| Target Price | $34 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.