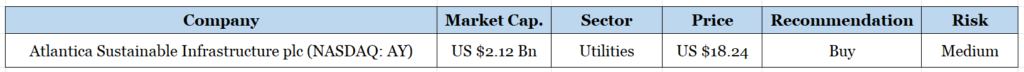

Atlantica Sustainable Infrastructure (NASDAQ: AY) drives global renewable energy transition

Atlantica Sustainable Infrastructure plc (NASDAQ: AY) is a prominent global player in the renewable energy sector, committed to driving the transition towards a sustainable and low-carbon future. Through its diverse portfolio of renewable energy, efficient natural gas, electric transmission lines, and water assets, the company actively contributes to reducing greenhouse gas emissions and promoting environmental sustainability worldwide.

With investments spanning across continents and a focus on long-term, stable cash flows, Atlantica Sustainable Infrastructure plc’s business model underscores its dedication to delivering impactful and profitable solutions in the renewable energy space. As the world continues to prioritize sustainability and clean energy initiatives, Atlantica’s role in advancing renewable infrastructure remains pivotal.

Moving forward, Atlantica Sustainable Infrastructure plc is poised to capitalize on emerging opportunities in the renewable energy market, while remaining steadfast in its commitment to sustainability, innovation, and responsible business practices.

Highlights and News Updates

- On March 25th, 2024, Atlantica Sustainable Infrastructure Acquires Two Wind Assets in Scotland.

- On March 4th, 2024, Analysts are bullish on Atlantica Sust Infra.

- On March 1st, 2024, Atlantica Sustainable Infrastructure Clocks Mixed Q4 Results, Sets Optimistic FY24 EBITDA And Cash Goals.

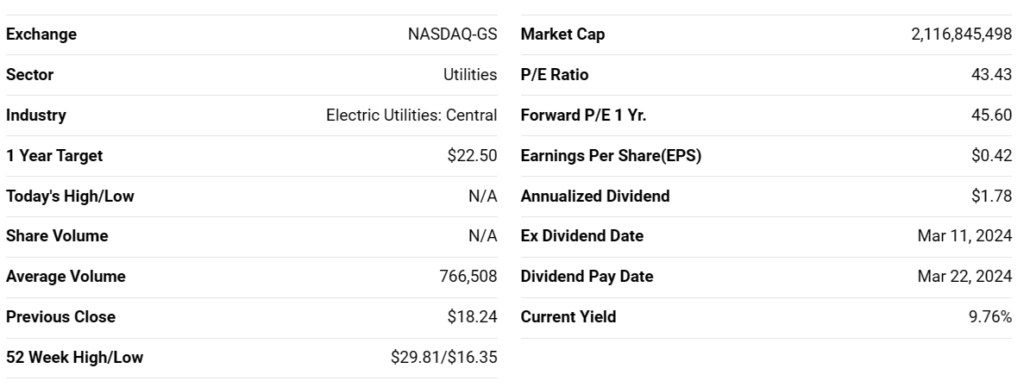

Key Data

Fourth Quarter 2023 Highlights

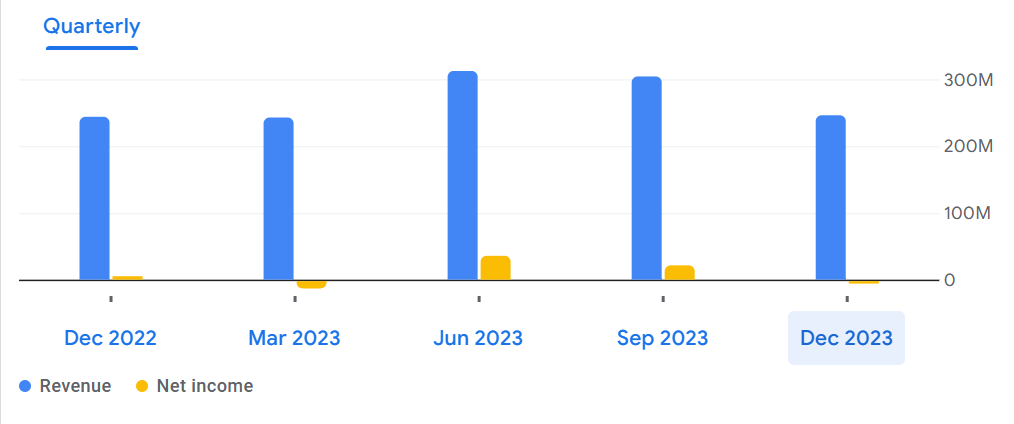

- Revenue of US $241.3 million, missing the consensus of US $245.8 million. Operating profit declined to US $50.5 million from US $58.7 million a year ago.

- Adjusted EBITDA increased to US $167.6 million from US $166.5 million the prior year. EPS of US $0.02, beating the consensus loss of US $(0.23).

- Operating cash flow stood at US $388.0 million in 2023 vs. US $586.3 million in 2022.

- Cash Available for distribution (CAFD) for the quarter fell to US $51.6 million from US $58.9 million the prior year.

Financials

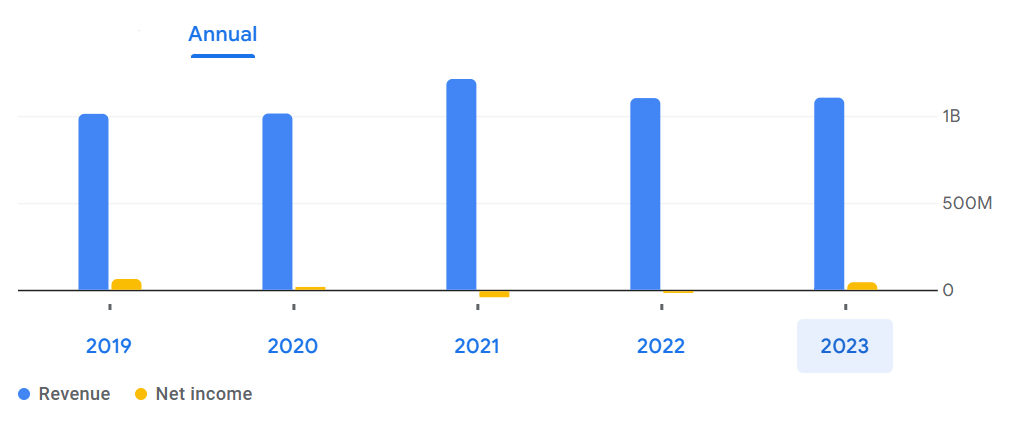

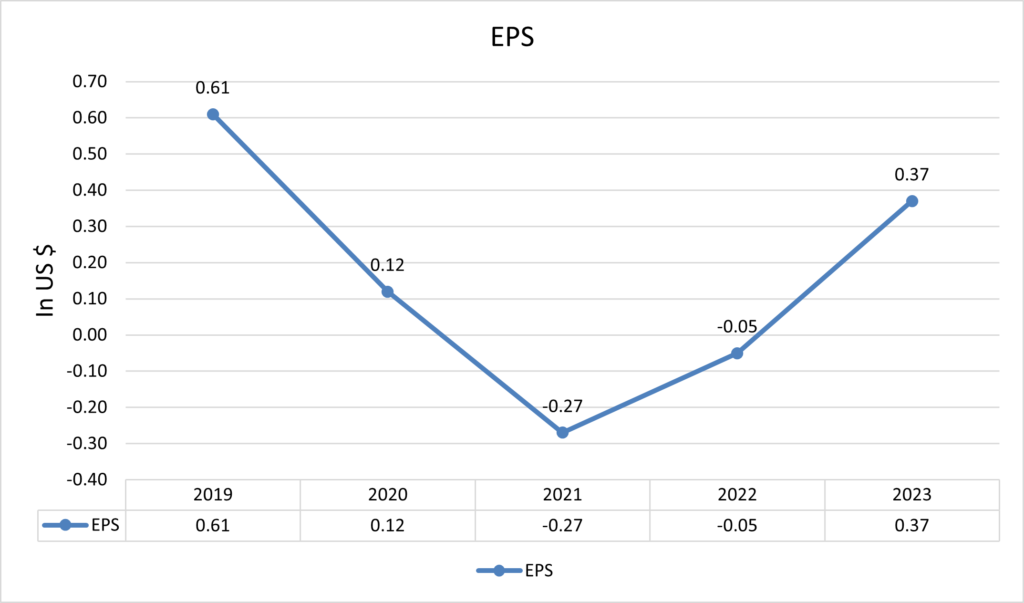

Revenue for the year ending December 31, 2023, amounted to US $1.10 billion, which is slightly lower than the previous year’s revenue of US $1.102 billion in 2022 and significantly lower than the revenue of US $1.212 billion in 2021. The gross profit remained consistent over the past three years, with US $1.10 billion in 2023, US $1.102 billion in 2022, and US $1.212 billion in 2021. This stability suggests that despite fluctuations in revenue, the company has been able to maintain its profitability margins. Sales, general, and administrative expenses decreased from US $351 million in 2022 to US $340 million in 2023. This reduction may indicate efforts to improve operational efficiency. Other operating expenses decreased slightly from US $474 million in 2022 to US $418 million in 2023. However, these expenses still represent a significant portion of the company’s total expenses. Operating income improved to US $342 million in 2023 from US $278 million in 2022, but it is lower compared to US $354 million in 2021. This indicates that the company’s operational performance has shown some recovery but has not yet reached the levels seen in 2021. Net income for the year 2023 amounted to US $43 million, which marks a positive turnaround from a net loss of US $5.443 million in 2022. However, it is still significantly lower than the net income of US $11.968 million recorded in 2020. EBT was positive at US $37.238 million in 2023, compared to a negative EBT of US -$11.776 million in 2022. This indicates that the company was able to generate taxable income during the year.

The quarterly financial performance of Atlantica Sustainable Infrastructure plc from Q2 2022 to Q4 2023 exhibits a mixed pattern of fluctuations. While there were instances of revenue, gross profit, and operating income improvements in certain quarters, others experienced declines or remained relatively stagnant.

Notably, Q3 2023 stood out with significant increases in gross profit, operating income, and pretax income, indicating a period of notable performance. However, it’s important to highlight that the net income for Q4 2023 turned negative, warranting closer scrutiny into the company’s operational efficiency and cost management.

These fluctuations underscore the inherent volatility and challenges within the renewable energy sector, which can be influenced by factors such as regulatory changes, market dynamics, and project-specific variables.

Moving forward, Atlantica Sustainable Infrastructure plc would benefit from a strategic focus on stabilizing revenue streams, optimizing operational efficiency, and mitigating risks to ensure sustained profitability and long-term growth.

Given the complexity of the renewable energy market, ongoing monitoring and adaptive management strategies will be crucial for Atlantica to navigate uncertainties effectively and capitalize on emerging opportunities in the evolving landscape of sustainable infrastructure.

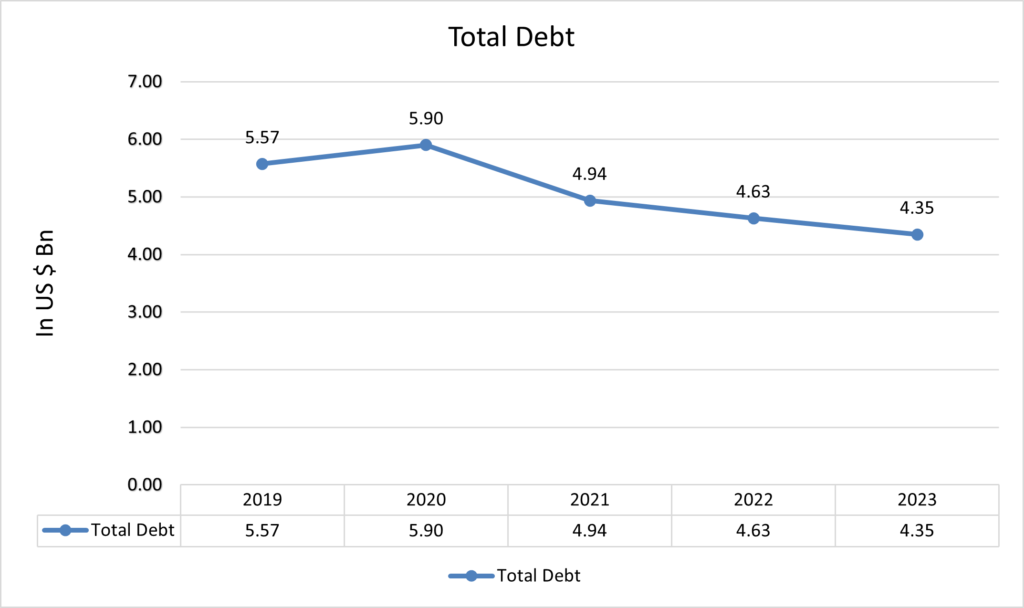

This decreasing trend in total debt suggests that Atlantica Sustainable Infrastructure plc has been actively managing its debt levels, potentially through debt repayments or refinancing strategies. A reduction in total debt can improve the company’s financial flexibility and reduce its financial risk exposure, which may positively impact its overall financial health and stability. The company has total assets worth of US $8.71 billion including cash of US $448 million.

Currently, the EPS of the company is US $0.37 up from US $-0.05 compared to last year’s EPS.

Forecast

Right now, the company is trading at US $18.24 with a 1-year projected target of around US $21.56 and a low estimation of US $17.24; the average price target is US $19.88.

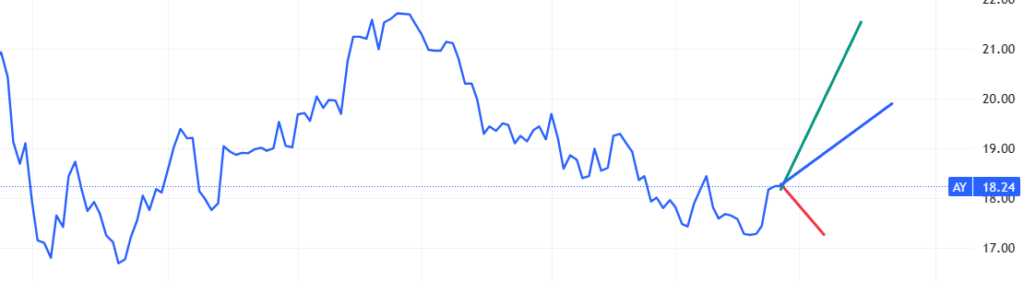

Technical Analysis

- The stock has corrected more than 15% and it has taken support on its support level.

- Right now, the RSI (53.46) indicator is above 50, and it also gives us a bullish divergence.

- The stock has the potential to bounce back up to 10%-18% from the current market price. Analysts are bullish on this stock.

- The stock is making a W pattern.

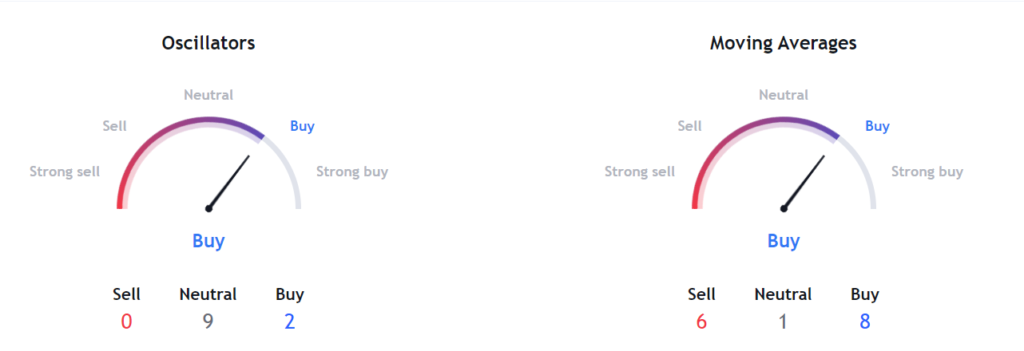

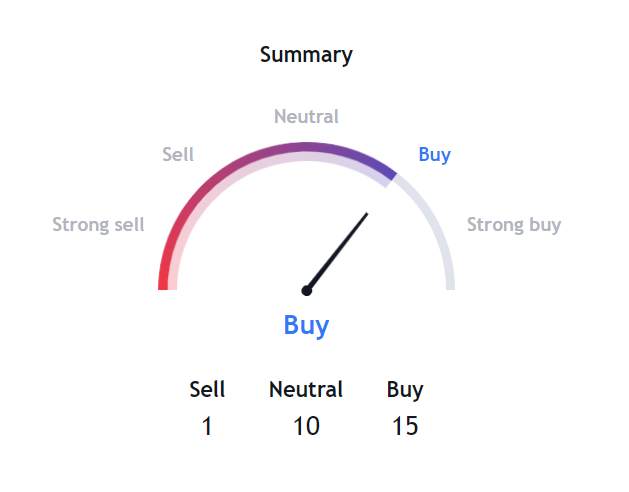

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Market sentiments are bullish.

- Momentum Indicator is giving a buy signal.

- Moving averages are giving us a buy signal.

Risk factors

While Atlantica Sustainable Infrastructure plc operates in the renewable energy sector, which presents opportunities for growth and sustainability, there are several risks associated with the company:

- Fluctuations in energy prices, supply and demand dynamics, and competition within the renewable energy market can affect Atlantica’s revenue and profitability. Market saturation or oversupply in certain regions may lead to pricing pressures and reduced margins.

- Challenges related to project development, construction delays, equipment failures, or operational disruptions can impact the company’s revenue generation and project timelines.

- Dependency on debt financing for project development and expansion exposes the company to interest rate fluctuations, refinancing risks, and credit rating downgrades. Tightening credit markets or unfavorable financing terms may constrain the company’s ability to fund growth initiatives.

- Environmental factors such as extreme weather events, natural disasters, or climate change impacts can affect the performance and resilience of renewable energy assets. Operational disruptions, damage to infrastructure, or changes in resource availability may lead to financial losses.

- Rapid advancements in renewable energy technologies and energy storage solutions may render existing assets obsolete or less competitive. Failure to adapt to technological innovations or invest in research and development could hinder the company’s long-term growth prospects.

- Currency exchange rate fluctuations, interest rate risks, and exposure to volatile financial markets can impact the company’s cash flow, profitability, and ability to meet financial obligations.

Stock Recommendation

Atlantica Sustainable Infrastructure plc presents a compelling investment opportunity within the renewable energy sector. Its focus on sustainable infrastructure, diversified asset portfolio, and global presence offers resilience against market fluctuations and regulatory changes. The company’s stable cash flows, attractive dividend yield, and potential for growth underscore its appeal to both income-oriented and growth-focused investors.

Furthermore, Atlantica’s commitment to environmental sustainability aligns with evolving ESG considerations, attracting socially responsible investors seeking to support companies with positive societal impact.

With a strong management team driving strategic initiatives and navigating industry complexities, Atlantica is well-positioned to capitalize on the increasing demand for renewable energy worldwide. Despite risks inherent in the sector, Atlantica’s strengths in geographic diversification, project stability, and financial management mitigate potential downsides.

In essence, Atlantica Sustainable Infrastructure plc offers investors an opportunity to participate in the transition to a cleaner, more sustainable energy future while potentially realizing attractive returns and contributing to positive environmental outcomes.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $18.24 as of March 26th, 2024.

| CMP (US) (March 26, 2024) | $18.24 |

| Target Price | $21.56 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.