AES Corporation (NYSE: AES) – Top pick for sustainable mid to long-term investment

The AES Corporation (NYSE: AES) functions as a diversified power generation and utility company, engaged in the ownership and operation of power plants for the production and sale of electricity to various customers, including utilities, industrial users, and intermediaries. Additionally, the company manages utilities involved in the generation, distribution, transmission, and sale of electricity to end-users in residential, commercial, industrial, and governmental sectors.

AES participates in the wholesale electricity market and employs a variety of fuels and technologies such as coal, gas, hydro, wind, solar, and biomass, including renewable sources like energy storage and landfill gas. With a diverse generation portfolio boasting around 32,326 megawatts, the company has a global presence, conducting operations in the United States, Puerto Rico, El Salvador, Chile, Colombia, Argentina, Brazil, Mexico, Central America, the Caribbean, Europe, and Asia. Formerly known as Applied Energy Services, Inc., the company adopted the name The AES Corporation in April 2000 and was initially incorporated in 1981, with its headquarters located in Arlington, Virginia.

Highlights and News Updates

- On December 21st, 2023, the company announced that it has closed minority sell-downs of its businesses in the Dominican Republic and its AES Colón business in Panama for proceeds of US $338 million.

- On December 15th, 2023, Tish Mendoza, Executive Vice President and Chief Human Resources Officer, sold 21,594 shares in AES for US $409,206.

- On December 11th, 2023, AES increases its quarterly dividend by 4% to US $0.1725 per Share; Payable Feb. 15 to Shareholders of Record Feb. 1.

- On November 30th, 2023, the company has agreed to sell its 51% stake in the Mong Duong coal-fired plant in Vietnam to Sev.en Global investment.

- On November 17th, 2023, Fluence Energy a joint venture between AES and Siemens named Ahmed Pasha as chief financial officer, effective Jan. 1, succeeding Manavendra Sial.

Key Data

Third Quarter 2023 Highlights

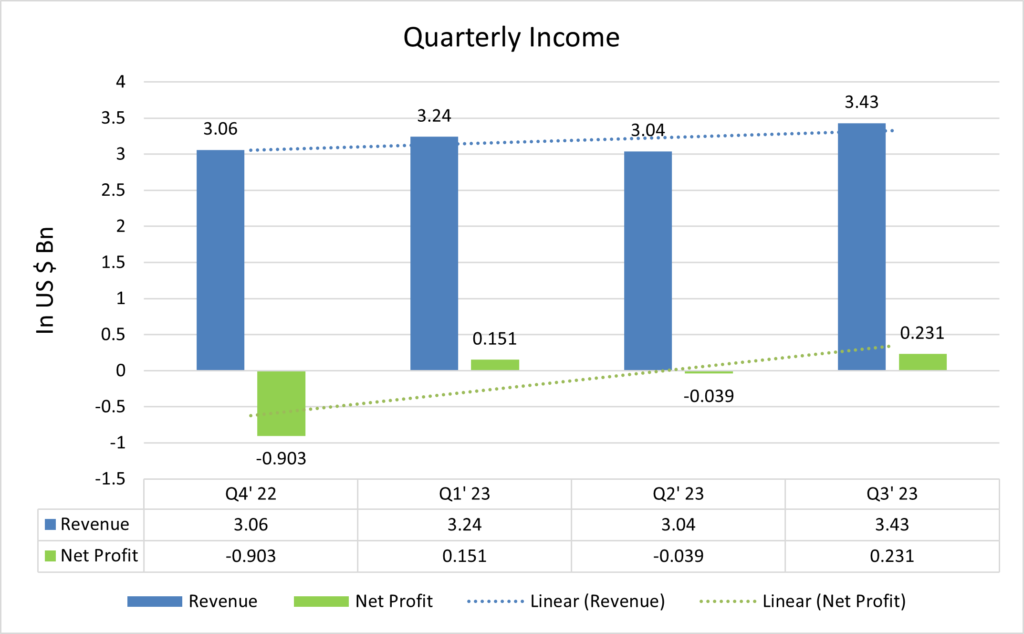

- Revenue for the quarter ended Sept. 30 was US $3.43 billion, compared with US $3.63 billion a year earlier.

- The company posted a 33% increase in quarterly renewables segment revenue to US $708 million.

- The utility firm also said it has been awarded up to US $2.4 billion of grant funding by the U.S. Department of Energy for two green hydrogen hubs with AES participation.

- AES expects its 2023 adjusted profit outlook in the top half of between US $1.65 per share and US $1.75 per share.

- The net earnings stood at US $231 million. EPS was at US 0.32 cents.

Financials

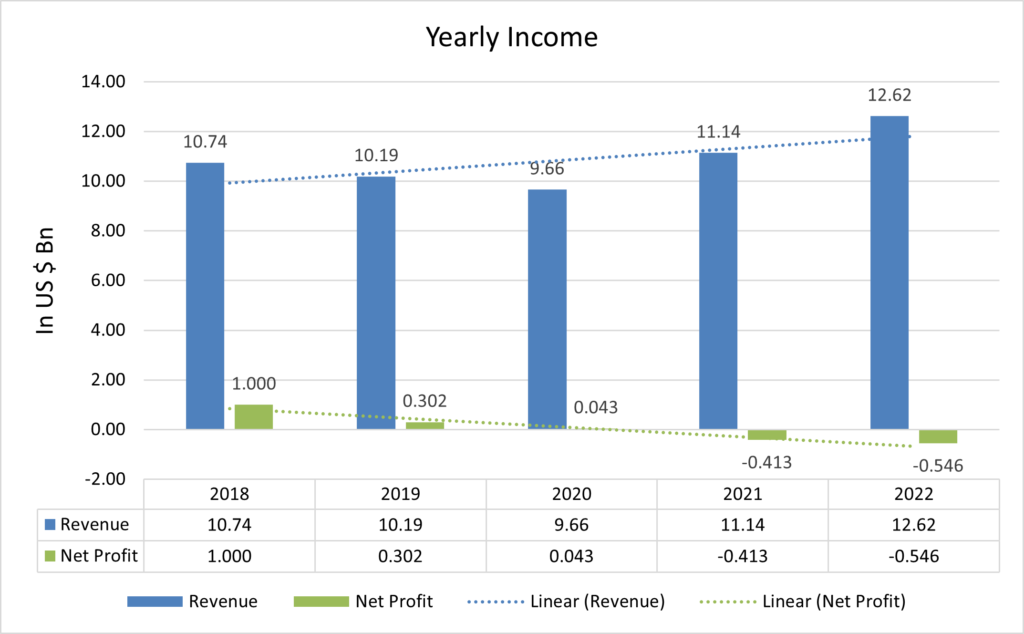

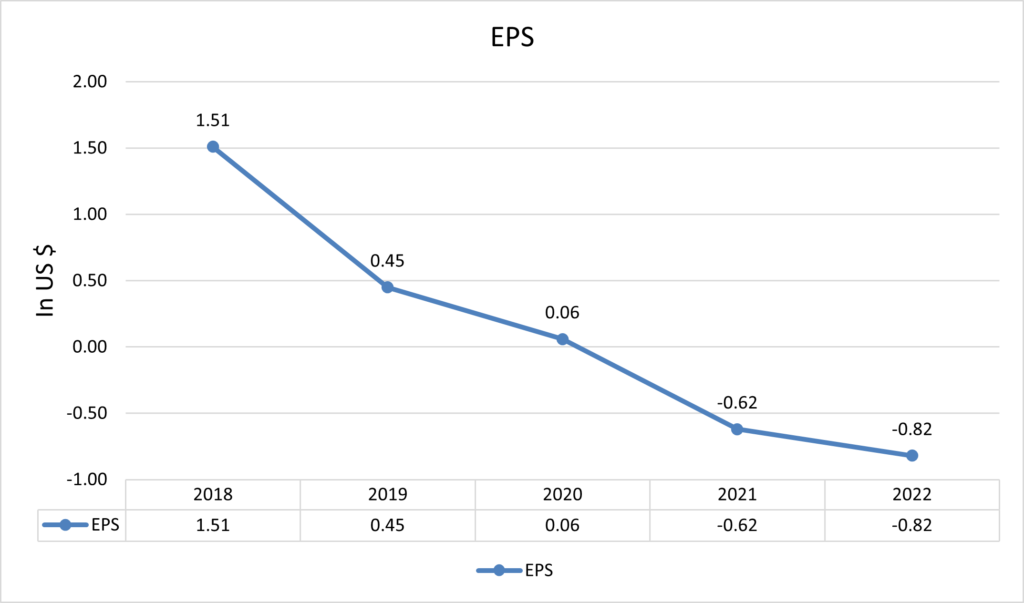

The AES Corporation, once a profitable energy giant, has walked a financial tightrope in recent years. From FY2018’s billion-dollar profit, their path has steadily descended, culminating in significant losses by FY2022. This concerning trend can be attributed to a double whammy: rising costs of goods sold, likely driven by expensive fuel and operational inefficiencies, and persistently high recurring expenses, including hefty fixed costs and investments in renewable energy. This perfect storm has squeezed profit margins, leaving the company precariously balanced between red and black. To regain financial stability, The AES Corporation must navigate strategic cost reductions, potentially by optimizing supply chains and scrutinizing recurring expenses. Additionally, exploring alternative fuel sources and improving operational efficiency could provide much-needed relief. Only by effectively maneuvering these challenges can The AES Corporation rewrite its financial narrative and reclaim its footing on solid ground.

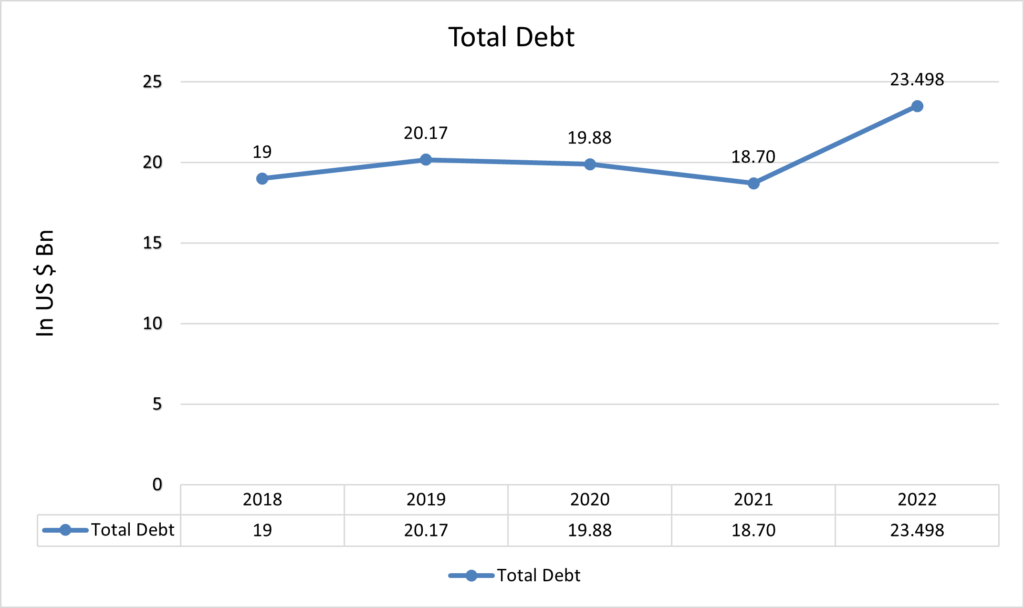

As of September 2023, The AES Corporation reported a total debt of US $25 billion, constituting 63.46% of its total assets. This debt-to-asset ratio is notably higher than the utilities sector’s average, which stands at approximately 50%. The elevated level of indebtedness amplifies the financial risk for the company, rendering it more susceptible to adverse effects from escalating interest rates and economic downturns. The predominant portion of The AES Corporation’s debt comprises long-term bonds and notes, with maturities spanning from 5 to 30 years.

While this structure diminishes the immediate risk of default, it still imposes a substantial burden on the company through considerable interest payments. The company’s financial position warrants scrutiny, given the departure from the industry norm and the potential challenges associated with servicing such a substantial debt load.

The AES Corporation’s financial performance in 2023 has been a roller coaster, oscillating between profits and losses quarter to quarter. While revenue remained relatively stable at around US $3.2 billion, profitability swung wildly. Q1 and Q3 saw healthy profits of $151 million and US $231 million, respectively, likely due to favorable market conditions or one-time events.

However, Q4 2022 and Q2 2023 brought significant losses of US $903 million and US $39 million, suggesting underlying issues impacting the company’s bottom line. These stark fluctuations highlight the need for The AES Corporation to address persistent cost pressures and explore strategies for more consistent profitability.

Currently, the yearly EPS of the company is US -$0.82 down by -32.31% compared to last year’s EPS.

Forecast

Right now, the company is trading at US $19.28 with a 1-year projected target of around US $25.75 and a low estimation of US $15.60; the average price target is US $22.18.

Technical Analysis

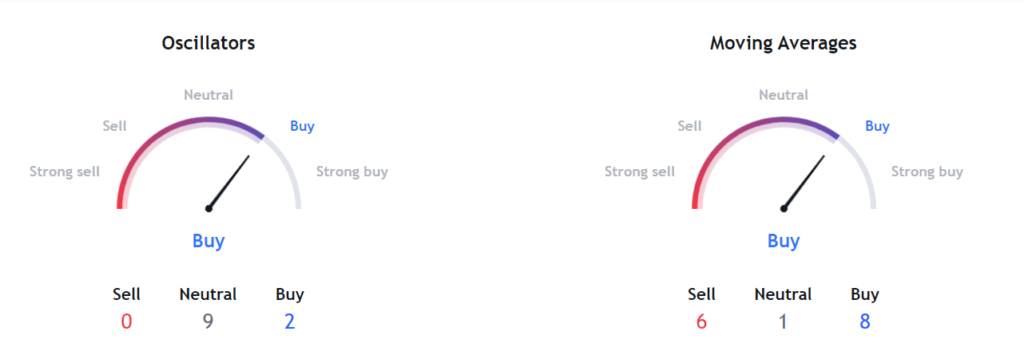

- Right now, the RSI (63.33) indicator is above 50 it is a good time to invest in this stock.

- The stock has the potential to bounce back up to 33% from the current market price. Analysts are bullish on this stock.

- The stock has broken the pattern by moving up above its resistance line.

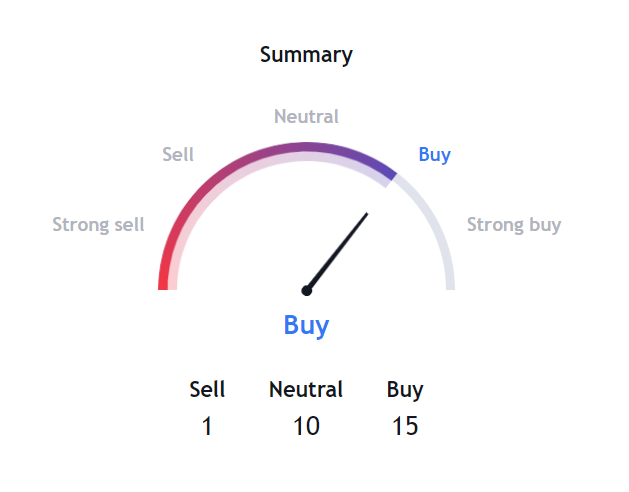

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Market sentiments are bullish. The MACD indicator is giving a bullish signal.

- VWAP (18.53) indicator is bullish on the stock.

- Stock is above 50 days EMA.

Risk factors

Based on the available information, here are some potential risks associated with The AES Corporation:

- The company has a significant debt burden, with a debt-to-equity ratio above 4. This makes them vulnerable to rising interest rates and economic downturns that could impact their ability to service their debt.

- High COGS due to factors like fuel costs and inefficiencies squeeze the profit margins and limit the potential earnings.

- While investing in renewables is necessary for long-term sustainability, it can come with high upfront costs and uncertain returns, potentially impacting current financials.

Stock Recommendation

Benefiting from a robust leadership team equipped with extensive experience in the energy sector and a dedicated focus on renewable energy, The AES Corporation is actively steering its operations towards sustainable practices. This strategic shift aligns with the growing emphasis on renewable energy sources, reflecting long-term industry trends and heightened environmental considerations. The company’s commitment to diversifying energy sources across multiple countries insulates it to some extent against market fluctuations in specific regions or sectors. Furthermore, there is speculation among analysts that the company’s stock price may be undervalued, presenting an opportunity for potential capital appreciation. This underscores the company’s potential attractiveness to investors looking to align their portfolios with the evolving landscape of renewable energy and capitalize on perceived market undervaluation.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $19.28 as of Dec 27th, 2023.

| CMP (US) (December 27, 2023) | $19.28 |

| Target Price | $25.75 |

| Recommendation | Buy |

The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.