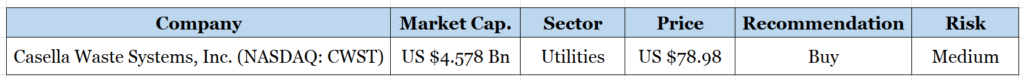

Casella Waste Systems, Inc. (NASDAQ:CWST): Green Energy Mid-Term Pick Worth Considering

Casella Waste Systems, Inc. (NASDAQ: CWST) is a prominent player in the waste management industry, renowned for its comprehensive environmental solutions and commitment to sustainability. Headquartered in Rutland, Vermont, the company operates throughout the northeastern United States, providing a diverse range of services to manage and dispose of solid waste. Casella Waste Systems is recognized for its innovative approaches to waste management, incorporating recycling, resource recovery, and energy generation into its practices. The company places a strong emphasis on environmental responsibility, striving to minimize the ecological impact of waste disposal. With a focus on community engagement, Casella Waste Systems actively collaborates with local municipalities and businesses to develop customized waste management strategies that align with both environmental and economic goals. The company’s dedication to sustainability, coupled with its extensive experience in waste management, positions Casella Waste Systems as a key contributor to the ongoing efforts to create a more environmentally conscious and efficient waste disposal infrastructure.

Highlights and News Updates

- On October 17th, 2023, Becton, Dickinson, and Company a leading global medical technology company, and Casella Waste Systems, Inc. a solid waste, recycling, and resource management services company, today the most recent results of a recycling pilot to manage discarded syringes and needles that led to 40,000 pounds of medical waste being recycled and diverted from disposal.

- On September 5th, 2023, Casella Waste Systems, Inc. completed the acquisition of Consolidated Waste Services, LLC assets.

- On August 25th, 2023, Edmond Coletta, President and CFO, on August 23, 2023, sold 10,000 shares in Casella Waste Systems for US $816,600.

- On August 10th, 2023, Casella Waste Systems, Inc. announced pricing of up to US $35.0 Million of New York State Environmental Facilities Corporation Solid Waste Disposal Revenue Bonds (Casella Waste Systems, Inc. Project) Series 2020R-2.

Key Data

Second Quarter 2023 Highlights

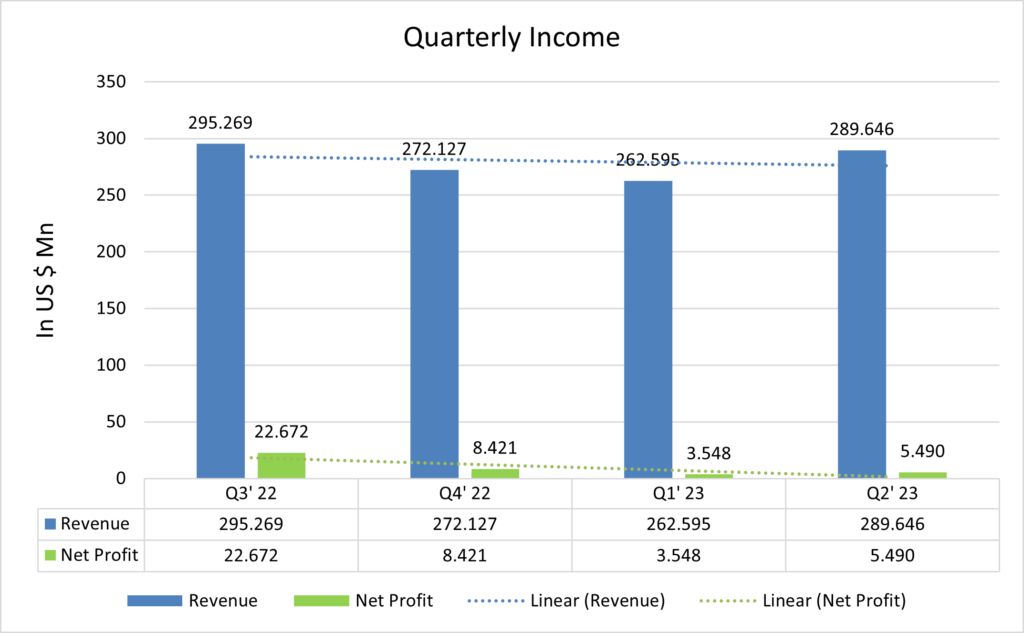

- Revenues were US $289.6 million for the quarter, up US $6.0 million, or up 2.1%, from the same period in 2022.

- Net income was US $5.5 million for the quarter, down US $-12.3 million, or down by 69.2%, from the same period in 2022.

- Net income was negatively impacted by several non-recurring items in the quarter, including a US $6.2 million legal settlement charge, a US $8.2 million loss from termination of bridge financing, and other one-time costs.

- Overall solid waste pricing for the quarter was up 7.7% from the same period in 2022, primarily a result of 8.2% higher collection pricing and 7.1% higher disposal pricing.

- Adjusted EBITDA, a non-GAAP measure, was US $72.2 million for the quarter, up US $3.7 million, or up 5.5%, from the same period in 2022.

- Net cash provided by operating activities was US $83.2 million for the year-to-date period, down US $-9.1 million, or down by 9.8%, from the same period in 2022.

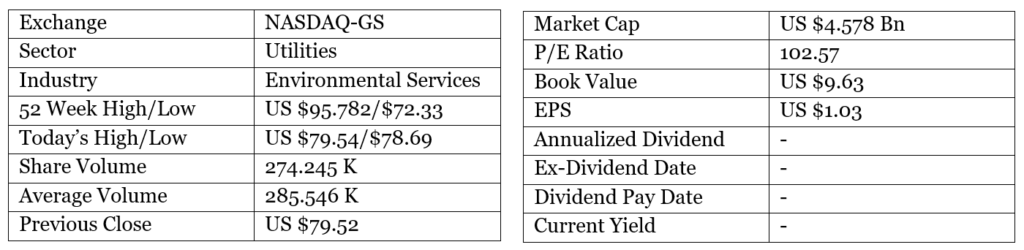

Financials

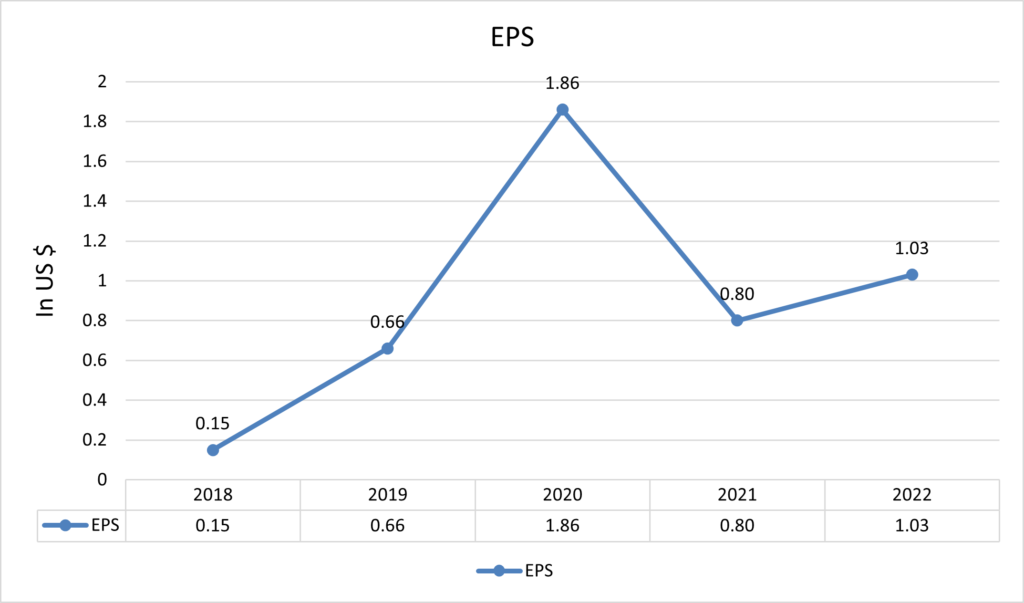

Over the last few years, the company has witnessed a substantial surge in revenue. Notably, in the fiscal year 2020, a period marked by economic challenges for businesses worldwide due to the COVID-19 pandemic, the company demonstrated remarkable resilience by achieving a notable increase in revenue.

Despite the adverse conditions that prevailed during this fiscal year, the company not only sustained its financial performance but also generated a commendable profit. This positive financial outcome underscores the company’s adept management and strategic approach. Moreover, the company is well-positioned to augment its net profit further, given its specialized focus on addressing and mitigating environmental challenges. This commitment not only aligns with responsible corporate practices but also signifies the potential for sustained financial growth, reflecting the company’s robust business model and capacity to navigate diverse economic landscapes.

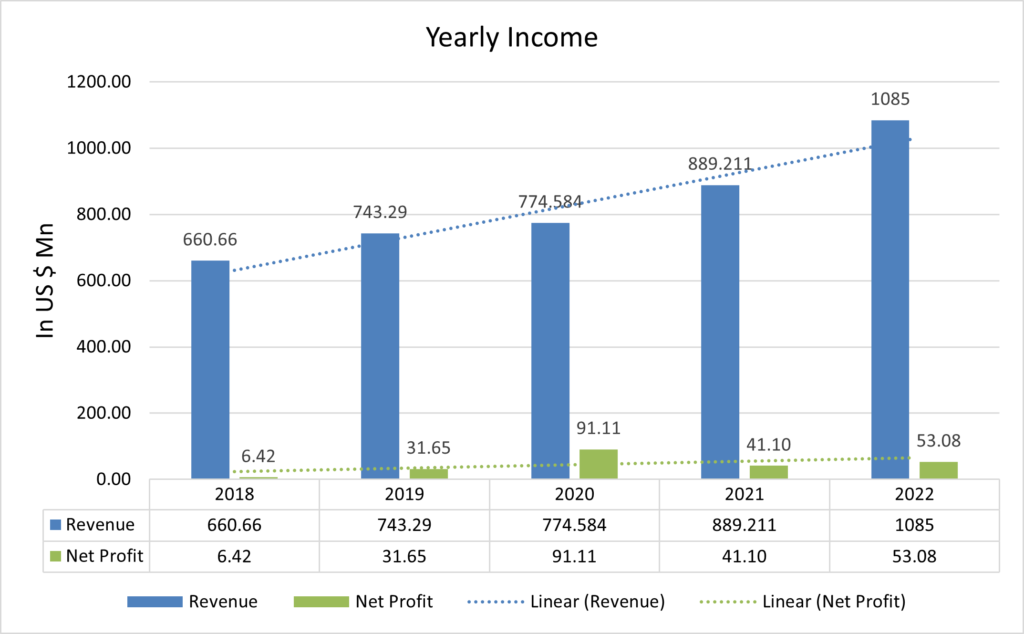

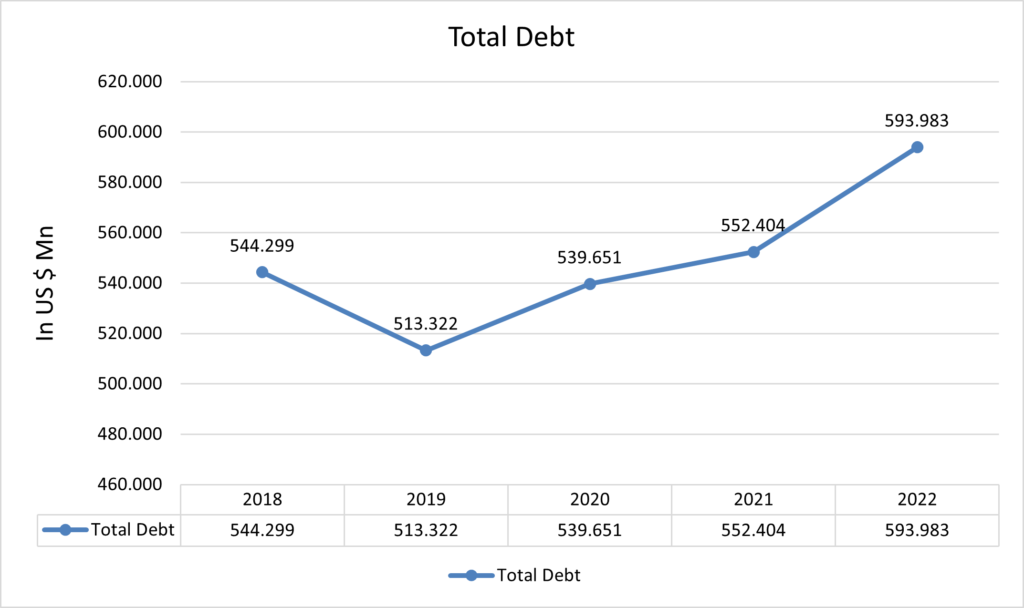

Evident from the graphical representation, the company’s debt exhibits a consistent upward trajectory. According to the FY2022 annual report, the company carries a total debt obligation amounting to US $593.983 million. Notwithstanding, the company maintains a robust asset portfolio, valued at US $1.449 billion, inclusive of a cash reserve amounting to US $71.152 million. It is noteworthy that the company has managed to reduce its negative retained earnings to US $171.920 million, reflecting a decline of 23.6%, which is a positive development.

However, the current debt level remains notably high. Given the financial landscape, it is advisable for the company to proactively manage and curtail its debt, implementing strategic measures to enhance financial stability and optimize the balance between liabilities and assets. This prudent approach will not only fortify the company’s financial standing but also contribute to sustained long-term growth and resilience in the ever-evolving economic landscape.

The company’s quarterly revenue exhibits a relatively consistent pattern, hovering within the range of US $262 million between US $295 million. However, despite the stability in revenue, the overall earnings remain modest, primarily attributed to influential factors such as elevated operating costs and substantial interest payments. These key financial metrics collectively exert a considerable impact, consuming a substantial portion of the company’s earnings. Addressing and mitigating the effects of these factors on profitability becomes imperative for the company to enhance its financial performance and optimize earnings in the long term.

It is imperative for the management to exercise effective control over these two pivotal factors in order to catalyze sustained growth for the company. By strategically managing and mitigating the impact of high operating costs and interest payments, the management can pave the way for enhanced financial performance and create a conducive environment for the company’s expansion and prosperity.

Right now, the company’s EPS is at US $1.03, up by 28.75% compared to last year.

Forecast

Presently, the company is trading at a value of US $78.98, with a projected 1-year target estimated at approximately US $98.22 and a lower estimation of US $74. The average consensus price target stands at US $90. The recommended buying price of the company will be US $78.98-$75.37.

Technical Analysis

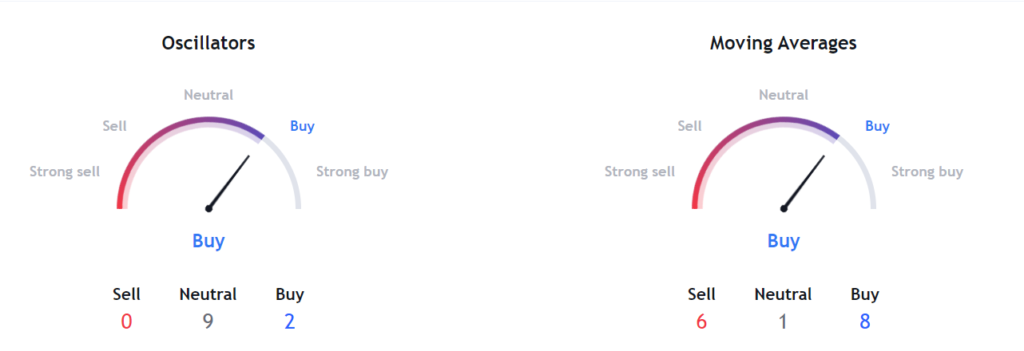

- The RSI indicator is above 50 level which is good. It is expected to go up.

- The stock has taken support on its trend line, which is a good signal.

- The stock has the potential to bounce back up to 24% from the current price level.

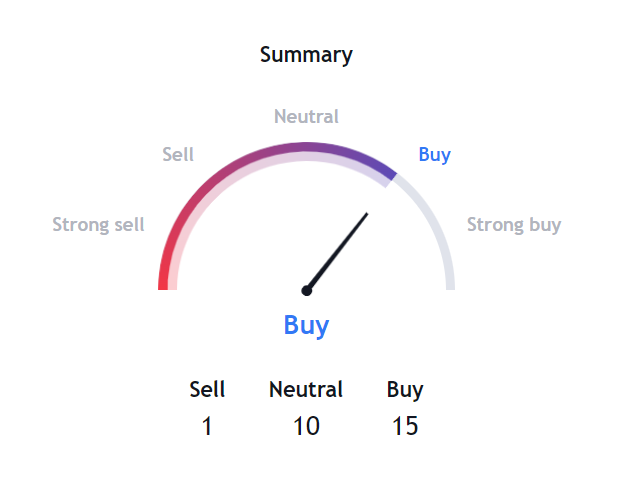

Indicators Summary – Buy

- The price action analysis of the stock indicates a positive uptrend in the stock in the upcoming days.

- Market sentiments are bullish, and stock can go up further.

- MACD is giving us a strong bullish signal.

- Momentum indicator is also giving us a buy signal.

ESG

Casella Waste Systems is deeply committed to environmental sustainability in the waste management sector. The company actively focuses on waste reduction, recycling, and resource recovery initiatives. It invests in technologies and practices that minimize the environmental impact of waste disposal. The incorporation of recycling programs and energy recovery processes underscores its dedication to environmental responsibility.

In terms of social responsibility, Casella Waste Systems engages with local communities and stakeholders. The company collaborates with municipalities and businesses to develop customized waste management solutions that align with local needs. It also places a strong emphasis on workplace safety and employee well-being, fostering a positive and inclusive corporate culture. Community involvement and social impact are integral aspects of Casella’s commitment to ESG values.

Governance is a key pillar of Casella Waste Systems’ ESG framework. The company emphasizes transparent and accountable governance practices. It upholds high standards of ethical conduct, compliance, and risk management. Casella’s leadership team plays a pivotal role in overseeing the company’s commitment to ESG principles, ensuring that corporate decisions align with the values of sustainability and social responsibility.

Risk

Like any publicly traded company, Casella Waste Systems, Inc. is exposed to various risks that could impact its operations, financial performance, and overall business outlook. Such as: –

- The waste management industry is subject to numerous environmental regulations and compliance requirements. Changes in legislation or stricter enforcement could lead to increased compliance costs or operational restrictions for Casella Waste Systems.

- The operational aspects of waste management involve various risks, such as accidents, equipment failures, or disruptions in waste collection and disposal. Any operational issues can lead to financial losses and damage to the company’s reputation.

- As a waste management company, Casella is exposed to potential environmental liabilities, including contamination of soil or water from waste disposal sites. Cleanup costs or legal liabilities related to environmental issues could impact the company’s financial health.

- The company currently bears a substantial debt load, necessitating proactive measures to manage and mitigate its impact. Failing to address this high level of debt may potentially undermine the financial strength of the company.

Stock Recommendation

Casella Waste Systems is committed to environmental sustainability. The company actively promotes waste reduction, recycling, and resource recovery initiatives, demonstrating a strong commitment to environmental stewardship.

Casella offers a comprehensive range of waste management services, including collection, recycling, and disposal. This diversity allows the company to cater to a wide range of customer needs and provides resilience against market fluctuations. Casella also invests in innovative technologies and practices to enhance its waste management processes. This commitment to innovation not only improves operational efficiency but also positions the company as a forward-thinking industry leader.

Despite economic challenges, such as the impact of COVID-19, Casella has demonstrated financial resilience. The company’s ability to navigate difficult economic conditions and sustain profitability reflects sound financial management. The company has implemented strategic growth initiatives, expanding its presence in the waste management market. This includes acquisitions and partnerships that position Casella for continued growth and market leadership.

MarketFacts gives a “Buy” rating on the stock at the price between US $78.98-$75.37 as of October 18th, 2023.

| CMP (US) (Oct 18, 2023) | $78.98 |

| Target Price | $98.22 |

| Recommendation | Buy |

Disclaimer: The information contained in this Website and the resources available for download through this website is not intended as, and shall not be understood or constructed as, financial advice. It is a general information based out of intensive research and is accurate at our end, providing valuable information. It should be understood as a recommendation that you should consult with a financial professional to address your particular information before making any decision.