Benefit from the growing demand of renewable energy with Brooksfield Renewable Corporation : (NYSE:BEPC)

Brookfield Renewable Corp. (NYSE: BEPC) is a distinguished entity specializing in acquiring and operating an extensive portfolio comprising renewable power and sustainable solution assets. This notable portfolio encompasses hydroelectric, wind, solar, and storage facilities, strategically positioned across North America, South America, Europe, and Asia.

The corporation operates across multiple domains, including renewable power and transition, infrastructure, private equity, real estate, and credit and insurance solutions, showcasing its commitment to a diversified and holistic approach to sustainable investments.

Founded on September 9, 2019, Brookfield Renewable Corp. is headquartered in the of New York, , underscoring its global presence and influential role in advancing environmentally responsible energy solutions. It operates a preeminent global platform committed to renewable power and decarbonization solutions, earning recognition as one of the foremost publicly traded entities within its sector.

Highlights and News Updates

- On July 5th, 2023, Utility firm Duke Energy said it would sell its commercial distributed generation business to private equity firm ArcLight Capital Partners in a US $364 million deal.

- On June 29th, 2023, approximately 241.7 million non-voting limited partnership units that are potentially eligible for issuance by the company have been registered.

- On June 13th, 2023, Brookfield Renewable was set to generate US $650 million via equity and private placement offerings.

- On June 13th, 2023, Duke Energy Renewables was acquired by Brookfield Renewable Partners with various institutions for a sum of US $1.05 billion.

- On June 13th, 2023, Duke Energy sold its Commercial Renewables unit in a US $2.8 billion deal.

- On May 24th, 2023, SPI Energy agreed to sell 18.25MW community solar portfolio in Oregon to Brookfield Renewable’s Luminace.

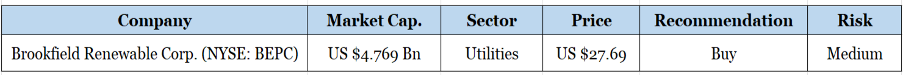

Key Data

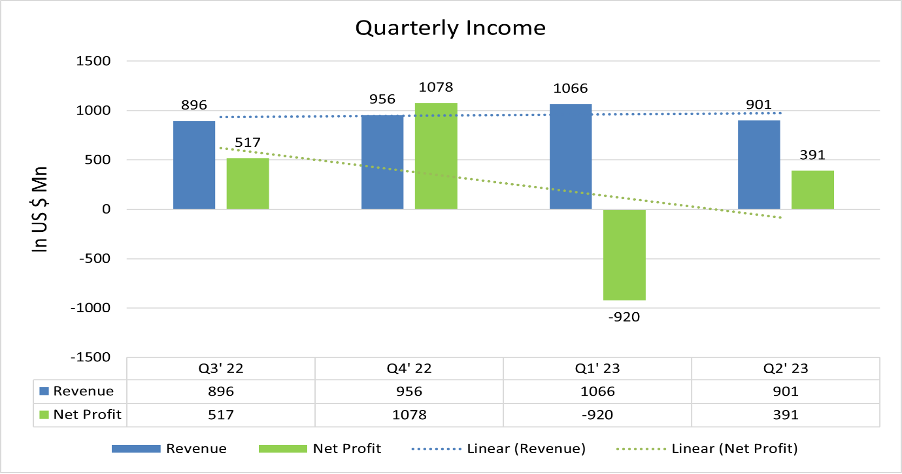

Second Quarter 2023 Highlights

- Total revenue was US $901 million, down by 9.63% compared to last year’s quarter.

- Net income was US $360 million, down by 68.33% compared to last year’s second quarter.

- Diluted earnings per share was US $0.72, down by 72.66% compared to last year’s quarter.

- Recently acquired and commissioned facilities contributed 557 GWh of generation and US $22 million to revenues.

- Recently completed asset sales that reduced generation by 315 GWh and revenues by US $23 million.

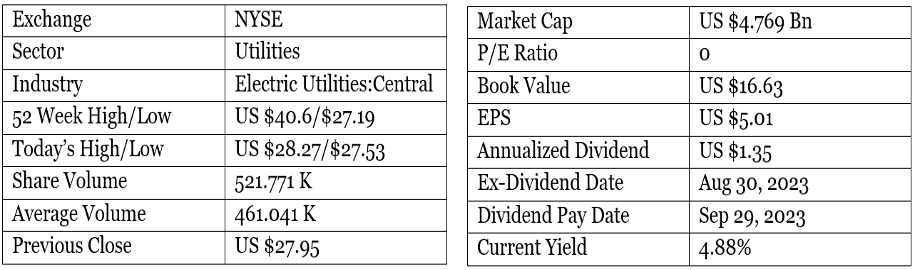

Financials

The company is currently experiencing a rapid growth in revenue attributed to the increasing demand and subsequent price escalation in energy consumption. This trend has significantly contributed to the company’s favorable financial outcomes. Notably, the revenue witnessed a decline in the fiscal year 2020, primarily attributable to reduced energy generation stemming from the repercussions of the COVID-19 pandemic. However, there has been a noteworthy resurgence in revenue in subsequent fiscal years. Specifically, in FY2022, the company’s revenue surged by an impressive US $411 million in comparison to the previous fiscal year, FY2021. Additionally, in FY2021, the revenue registered a substantial upswing of US $280 million when juxtaposed with the performance in FY2020.

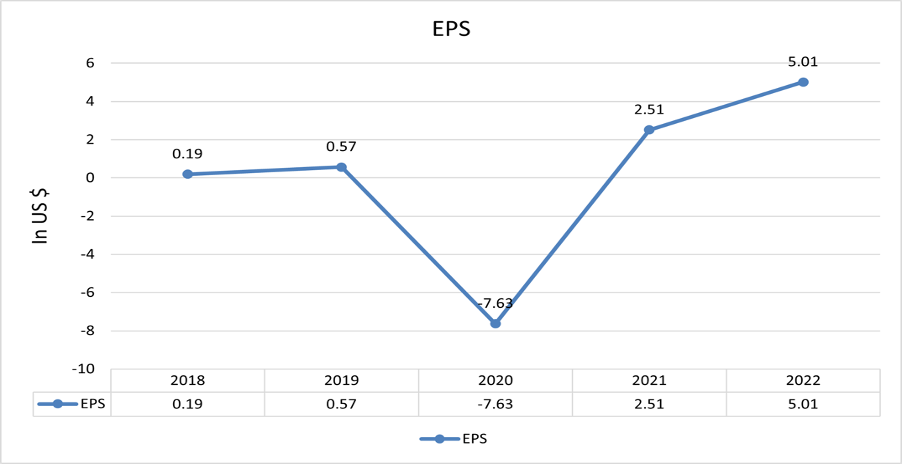

The profit of the company is also rising although it fell in FY2020 and went negative due to currency fluctuation, high direct operating cost which was US $1.061 billion, interest expenses of US $816 million, expenses of US $2.561 billion, and depreciation of US $1.065 billion.

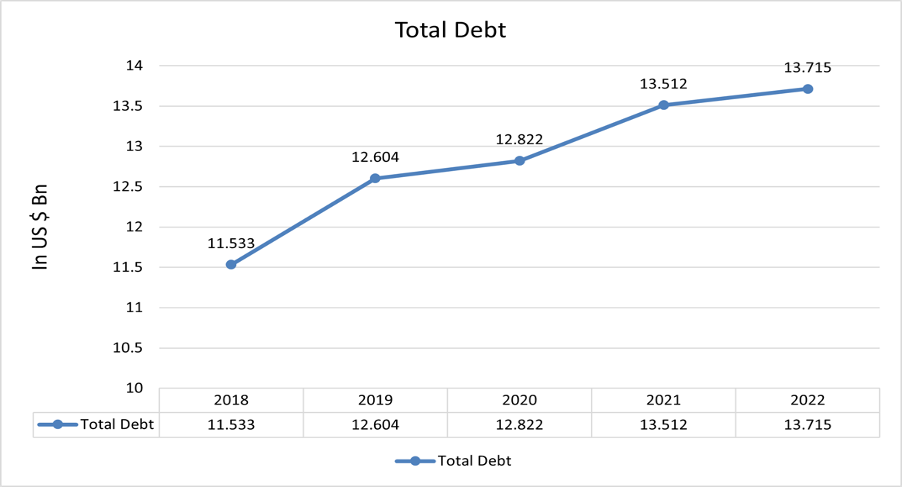

The company’s debt is currently experiencing a notable escalation, a trend that is frequently observed within enterprises functioning in the energy sector, where substantial debt is customary. As indicated in the FY2022 annual report, the company’s asset portfolio stands at US $43.288 billion, which encompasses a cash reserve of US $642 million. The debt incurred by the company has been supported by collateral.

The company’s quarterly revenue demonstrates a consistent pattern characterized by marginal fluctuations. The overall profitability remains favorable, although a notable exception occurred in the initial quarter of 2023, during which the company incurred a loss of US $920 million.

The EPS of the company is US $5.01 compared to last year’s EPS which was US $2.51 down by 99.60%.

Forecast

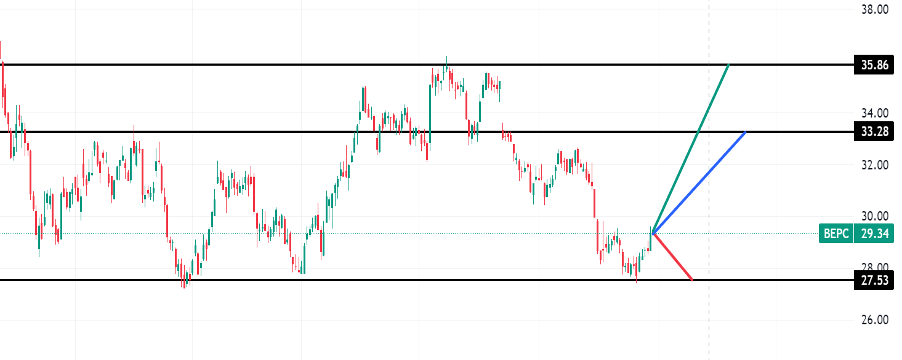

Currently, the company is trading at US $27.69 with a 1-year projected target of around US $35.86 and a low estimation of US $27.53; the average price target is US $33.28.

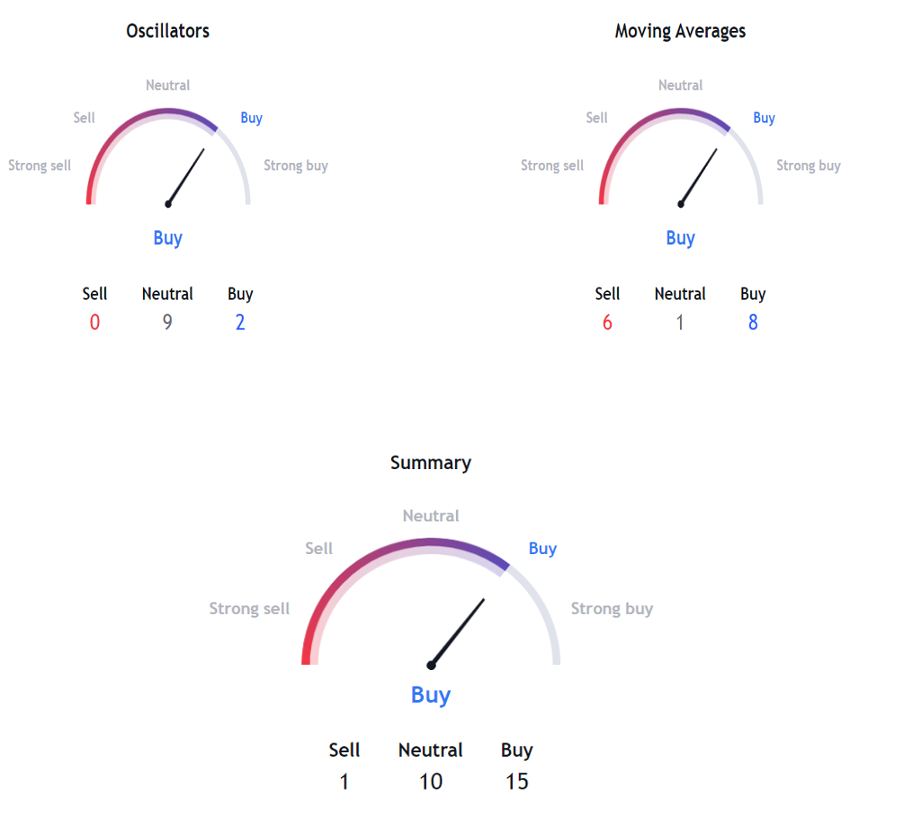

Technical Analysis

- The price action analysis of the stock indicates a positive uptrend in the stock.

- Right now, RSI (50.56) indicator is above 50 which shows it is a good time to invest in this stock.

- The stock has the potential to bounce back up to 24% from the current market price.

Indicators Summary – Buy

- Market sentiments are bullish, and stock can go up further.

- MACD (-0.57) indicator is giving a bullish signal.

- VWAP is also giving us a bullish signal.

ESG

The organization endeavours to mitigate the environmental impact of its operations and enhance the efficient utilization of resources progressively. It demonstrates its commitment to advancing the objective of achieving net zero greenhouse gas (GHG) emissions by 2050 or an earlier timeline. The organization cultivates a constructive work environment founded on the principles of upholding human rights, cherishing diversity, and unequivocally opposing any form of workplace discrimination, violence, or harassment.

The organization operates in accordance with best-in-class health and safety protocols, thereby aligning with the aspiration of eradicating high-risk safety incidents. Its operations are guided by the loftiest ethical standards, as manifested through the execution of business activities in strict adherence to its Code of Business Conduct and Ethics.

The organization actively nurtures robust relationships with its stakeholders, fostering transparency and meaningful engagement. It ensures that the interests, security, and well-being of the communities within which it operates are intrinsically woven into its business decisions.

Furthermore, the organization underscores its commitment to philanthropic endeavours and employee volunteerism, showcasing its dedication to giving back to society and participating in initiatives that contribute to positive societal transformation.

Risk factors

- Changes in energy prices could impact the company’s revenue and profitability. Variations in demand for renewable energy could affect the company’s growth prospects. Economic challenges can lead to reduced energy consumption and project delays. This is the biggest risk because if, the revenue of the company falls it will be tough for them to pay the interest payments, finance their operation, and also to invest in the new projects for their growth.

- The organization has undertaken substantial debt secured by significant collateral. Given the substantial debt exposure, the company is susceptible to fluctuations in interest rates, potentially impacting both borrowing expenses and strategic financing determinations.

- Operational disruptions, equipment failures, or technical challenges could also impact energy production and efficiency which will increase the expanses and decrease the revenue of the company.

Stock Recommendation

Brookfield Renewable operates within the dynamic landscape of the renewable energy sector, a realm currently experiencing remarkable global expansion. As the world increasingly pivots towards sustainable energy sources, enterprises within this sector find themselves strategically poised to harness the burgeoning demand for clean energy solutions. One of the compelling attributes of renewable energy projects is their capacity to yield stable and foreseeable cash flows, attributed to enduring contractual agreements and government incentives. This inherent stability contributes to the establishment of a dependable income stream, an attractive prospect for discerning investors.

The ongoing global commitment to curbing greenhouse gas emissions and addressing climate change ensures a sustained impetus propelling growth in the renewable energy arena. This momentum holds the potential to notably benefit companies like Brookfield Renewable, positioning them at the forefront of positive change.

MarketFacts gives a “Buy” rating on the stock at the closing price of US $27.69 as of September 1st, 2023.

| CMP (USD) (September 1, 2023) | US $27.69 |

| Target Price | US $36.50 |

| Recommendation | Buy |