Hitch a ride to the EV boom with Blink Charging Co. (NASDAQ:BLNK)

Blink Charging Co. (XNAS: BLNK) provides electric vehicle (EV) charging equipment and networked EV charging services in the United States and internationally. The Company was founded in 2009 and is headquartered in Miami Beach, Florida.

Blink offers residential and commercial EV charging equipment that enable EV drivers to recharge at various location types. The company offers its services through direct sales force and resellers, as well as sells residential Level 2 chargers through various internet channels. As of March 10, 2022, it deployed approximately 30,000 charging ports. It also provides Blink Network, a cloud-based system that operates, maintains, and manages various Blink charging stations and associated charging data.

Highlights And News Updates

- On October 26th, 2022, Blink Charging announced a donation of 10 Blink HQ 150 Level 2 chargers to the Tennessee Socially Equal Energy Efficient Development (SEEED), a non-profit that seeks to serve the young adults and largely marginalized community members in the greater Knoxville area.

- As of October 25th, 2022, the company announced a mutual service agreement with Triple J Enterprises, and the Guam Power Authority (GPA). The agreement calls for the deployment of Blink charging stations and related services to Triple J properties throughout the island of Guam, supported by GPA to maintain the electrical grid performance.

- Blink on October 18th, committed to establish a new manufacturing facility in the United States, which is expected to create new jobs and increase charger production capacity to meet growing market demand.

- The company also announced to make a donation of $10,000 to Florida’s Disaster Fundto support disaster recovery efforts for those who have been impacted by Hurricane Ian.

- On October 11h, 2022, Blink announced the launch of its entirely rebuilt Blink Network with market-leading architecture and responsiveness capable of meeting the needs of the Company as it continues to expand globally.

- Since January 2021, Blink charging received $30 million in grants and rebate awards from the government, and as of first quarter, it also received an extra $3 million.

- During the second quarter Blink acquired EV charging leader SemaConnect, further strengthening its competitive positioning in the industry by adding complete vertical integration of supply-chain, engineering, and in-house manufacturing capabilities of more than 10,000 EV chargers today and scaling to 50,000 per year.

- In April 2022, Blink acquired UK electric vehicle infrastructure leader EB Charging, adding more than 1,150 chargers to the Blink Charging footprint. Following the acquisition, EB Charging announced an agreement with Q-Park to deploy nearly 600 charging points across 80 sites in the UK and Ireland.

Second Quarter 2022 Highlights

- Total Revenues increased 164% to $11.5 million for the second quarter of 2022 compared to the second quarter of 2021.

- Adjusted EPS for the second quarter of 2022 was a loss of $0.41 compared to an Adjusted EPS loss of $0.31 in the prior year period.

- Product Sales increased 170% to $8.8 million in the second quarter of 2022, an increase of $5.6 million from the same period in 2021, primarily driven by increased sales of commercial chargers, DC fast chargers, and residential chargers.

- Service Revenues, which consist of charging service revenues, network fees, and ride-sharing service revenues, increased 154% to $2.2 million in the second quarter of 2022, up $1.4 million from the second quarter of 2021.

- Net Loss for the second quarter of 2022 was $22.6 million, or $(0.52) per share, compared to a Net Loss of $13.5 million, or $(0.32) per share, in the second quarter of 2021.

- Adjusted EBITDA for the second quarter of 2022 was a loss of $15.6 million compared to an Adjusted EBITDA loss of $8.1 million in the prior year period.

- As of June 30, 2022, Cash and Cash Equivalents totalled $85.1 million.

- In the second quarter, Blink completed the acquisition of SemaConnect, adding over 12,800 active chargers and 151,000 registered users to Blink’s portfolio.

- The second quarter results are indicative of the fundamental strengths of our business due to organic growth as well as growth from acquisitions

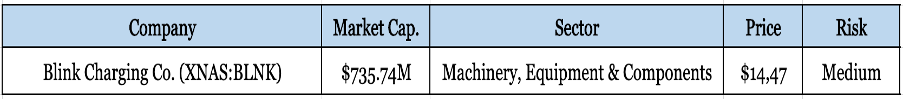

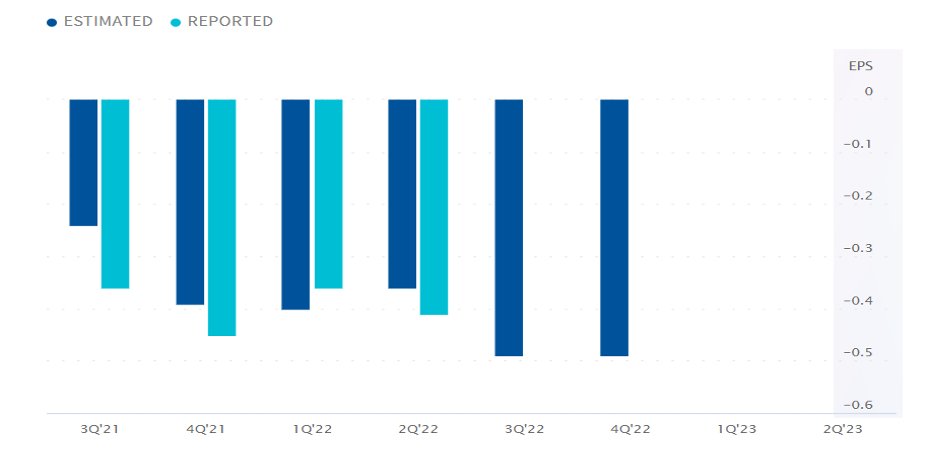

Key Data

Earnings Per Share

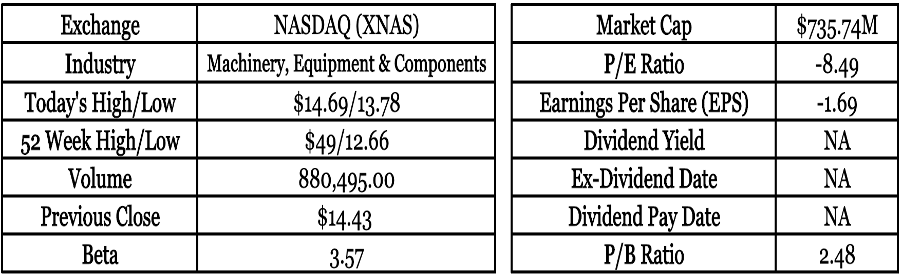

Based on 3 analysts forecasts, the consensus EPS forecast for the third and fourth quarter of 2022 is $-0.49. The reported EPS for the same quarter last year was $-0.36. The estimated EPS of second quarter 2022 $-0.36 and reported EPS is $-0.41.

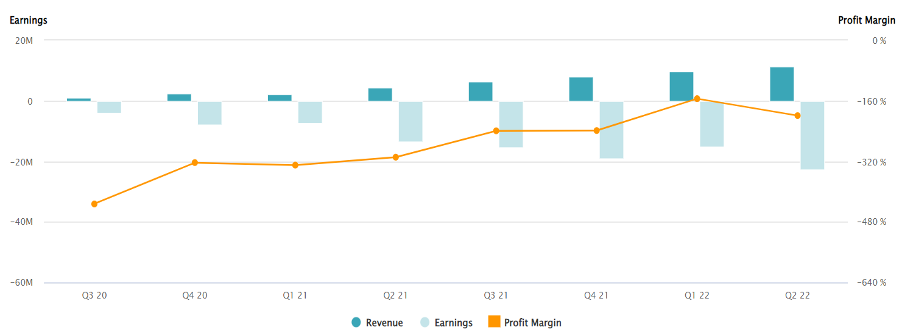

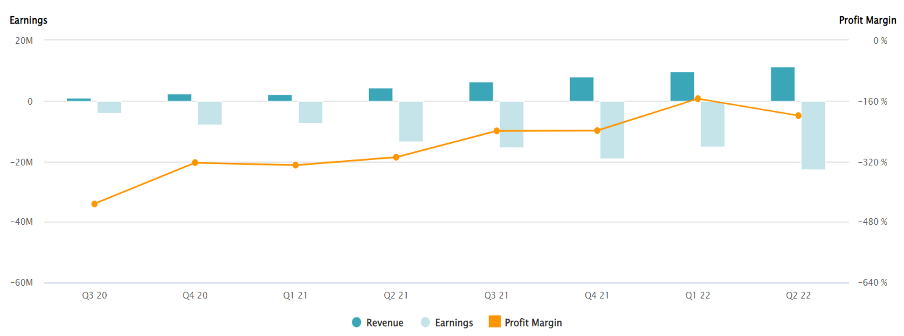

Blink Charging Co. Earnings & Revenue history

Quarterly: As of 30th June 2022, Blink projected a revenue of $ 11.36 M, an increase of 160.86% from the same quarter last year. Earnings of $- 22.62M and a profit margin of -199.11% were recorded.

Annually: As of 31st December, 2021, Blink generated a revenue of $20.94M, earnings of $-55.21M and a profit margin of -263.22%.

Forecast

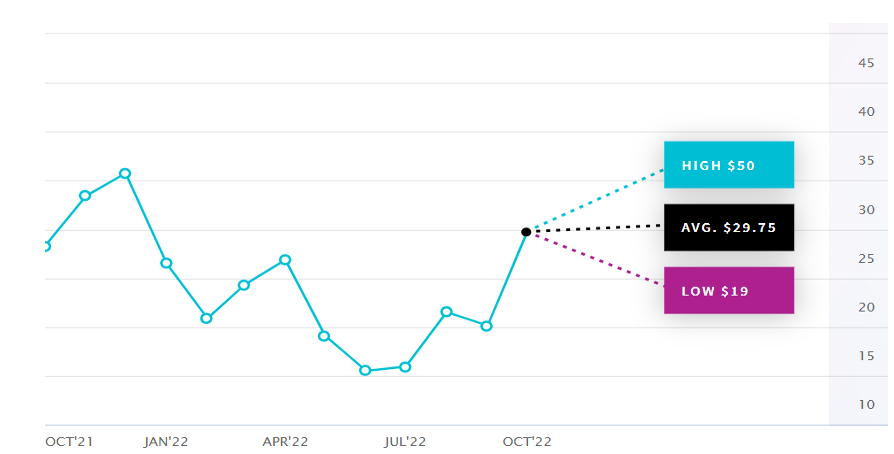

Based on 4 Wall Street analysts offering 12-month price targets for Blink Charging Co in the last 3 months. The average price target is $29.75 with a high forecast of $50.00 and a low forecast of $19.00. The average price target represents a 105.60% change from the last price of $14.47

Risk factors

- Just after the SemaConnect acquisition, Blink’s cash flows are running thin and it would be needing more cash by the end of this year.

- As of June 30, 2022, Blink’s operating cash was $-3.48 M, investing cash flows were $-212.66 K and that of financing was $14.76 M.

- The cause of concern is that the operating expenses are over 200% of revenues. Hence, Blink is likely to require more cash in the coming years.

Stock Recommendation

Blink estimates global EV sales to rise to 10 million by 2025 and then to 30 million by 2030. In August 2022, the market share of EVs increased from to 6% of the light-vehicle market as opposed to only 3.3% during the same month last year. With the government supporting the green initiatives with rebates and subsidies the future of the sector looks strong.

MarketFacts gives a “Buy” rating on the stock at the closing Price of $14.47 as of October 29th ,2022

| CMP (USD) (October 29, 2022) | $14.47 |

| Target Price | $19.50 |

| Recommendation | Buy |