What Is Equity Research and Why Is It Important?

There are many uncertainties surrounding the stock market, so investing in stocks has always been seen as a gamble. It is a common misconception in the stock market that success depends entirely on chance. A miracle may bring instant riches; a catastrophe may ruin all your hard work.

Everything is true to an extent, but equity research comes into play to protect people from the uncertainties of the stock market. Equity research acts as a timely and effective shield, ensuring the protection of investors.

A career in Equity Research can be very lucrative as well. If one wants to stay ahead, one needs sound judgment, the ability to think critically, the freedom to take the initiative, and the dedication to analyse.

What is Equity Research?

Equity research’s primary objective is to assist investors in making informed decisions regarding purchasing, holding, or selling a security or other investment.

Before buying a company’s shares, an investor must conduct extensive financial research, including ratio analysis, Excel forecasting (financial modelling), and scenario analysis.

Research analysts at equity firms report the findings and analysis of their investigations in their reports. These experts help investors make educated decisions by analysing company shares and determining, based on several factors, whether it is a worthwhile investment or not.

What is an Equity Research Report?

As the name implies, equity research reports are written by analysts and provide recommendations to investors regarding whether they should buy, hold, or sell company’s shares.

It also provides information about the company’s background, industry, management and financial performance, risks, and anticipated price. It also includes information about the company’s history.

What does an Equity Research Analyst or Associate do?

Equity researchers are responsible for writing reports, among their most significant responsibilities. Equity research associates or analysts publish a range of reports regularly, from short updates called “flash reports” to comprehensive reports called “initiating coverage.” Financial modelling is also an essential aspect of the job description.

Contents of an Equity Research Report

A well-written equity research report will not exceed 15 pages, and the content will be clear and concise. Reports prepared by analysts should communicate their viewpoints clearly to their readers.

Equity Research reports typically contain the following information:

- Summary and analysis from industry analysts

- Significant highlights of the company

- An overview of the market

- Analysis of Key Financial Ratios

- Valuation and Financial Modelling

- Risk factors

- Rating disclosure and justification

Reports on equity investments often include these details, but their presentation is not universally standardized.

Steps of Equity Research

Step 1- The first step comprises of analysing the economic conditions and industry specific factors. Major components of economic analysis include general economic conditions, consumer prices, inflation rates, interest rates, unemployment levels. Industry analysis is the analysis of a specific branch of manufacturing, service, or trade

Step 2 – Company analysis contains an evaluation and examination of a company, its financial health and prospects, its management or marketing activities and its strengths and weaknesses

Step 3 – Once you have a firm grasp of the company’s economics, you may evaluate prior performance by analysing the balance sheet, cash flow statement, and income statement included inside the company’s financial statements.

Step 4 – Create projections for financial statements such as the BS, IS, and CFs based on management’s expectations, past performance, and industry rivalry (also called Financial Modelling in Equity Research)

Step 5 – Consider applying discounted cash flow (DCF), relative values (RV), or a sum-of-the-parts (SOP) valuation to determine the fair market value.

Step 6 – Use the valuation mentioned above methods to arrive at a fair price, and then evaluate it in comparison to the relevant market price.

When the Fair Price is lower than the Market Price, shares of the firm are overpriced and should be considered a SELL investment.

When the Fair Price is higher than the Market Price, shares of the firm are under-priced and should be considered a BUY investment.

Step 7 – Now, the time is to Putting Together a Report that Will Display the Results of the Analysis.

Step 8 – Whether it be a presentation or a recommendation it must be shown in a crisp and concise way to tell the reader what the analyst is trying to convey.

Equity Research Report Example

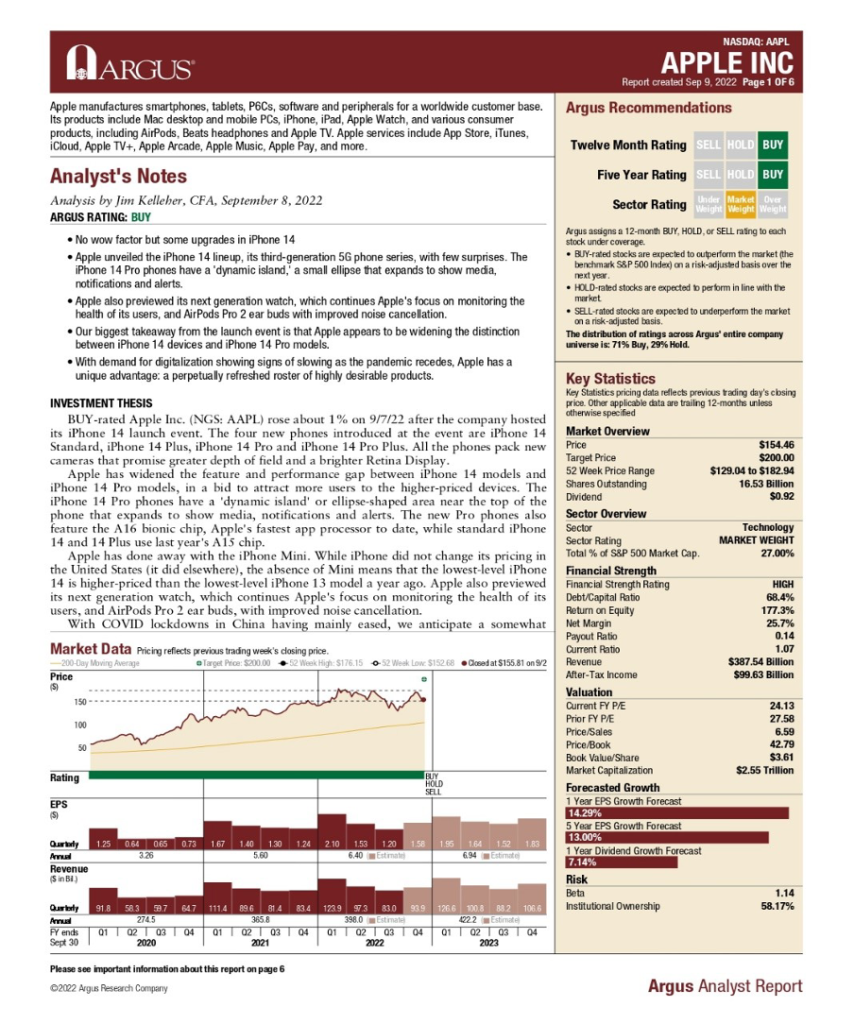

Below you can find a sample Apple equities research report that illustrates how the analyst presents a recommendation, target price, the latest developments, investment thesis, value, and risks.

The Bottom Line

With diligence and thorough equity research, any investor can maximize their investment returns with a systematic approach. Investing is risky, but with the proper steps, it will be profitable. Equity research makes recommendations based on an evaluation of a company’s fair value thus making investment an educated decision.

If an analyst chooses to pursue a career in equity research, they will earn more money and have better chances of moving on from their current employer. Research analysts, however, are ideal for those who enjoy constant change and challenge and are passionate about Finance and Financial Analysis.

FAQs

- What are the types of Equity Research?

A company engaged in equity research may fall into two categories: those working on the “buy” side or those working on the “sell” side.

- Is it hard to get into Equity Research?

A career in equity research might be challenging. Global investment banks and boutique firms have a limited number of analysts and associates and recruit a limited number of new employees each year.

- How long does it take to research a stock?

Experts can perform essential stock screening and fundamental analysis in as little as an hour or two, whereas novices may need more than four hours.