Is this solar energy stock worthy enough to be in your portfolio: Sunrun Inc.(NASDAQ: RUN)?

Sunrun Inc. (XNAS: RUN) is an American provider of photovoltaic solar energy generation systems and battery energy storage products, primarily for residential customers. The company was established in 2007 and is headquartered in San Francisco, California. Sunrun Inc. engages in the design, development, installation, sale, ownership, and maintenance of residential solar energy systems in the United States. The company markets and sells its products through direct-to-consumer approach across online, retail, mass media as well as its partner network. The company installs solar energy systems on its customers’ homes and provides them with the solar power produced by those systems for a 20- or 25-year initial term. It monitors, maintains, and ensures the system during the term of the contract.

Highlights And News Updates

- Mary Powell, CEO of Sunrun, joined President Joe Biden on September 13th, 2022, to celebrate the passage of the historic Inflation Reduction Act (IRA), which invests $369 billion to fight climate change.

- Sunrun announced to deliver more than 80 megawatts (MW) of stored solar energy capacity from customer batteries to the state’s electric grid daily to reduce strain and improve energy resilience for all Californians.

- Sunrun also announced the launch of its new Level 2 Electric Vehicle (EV) charger to compliment the Company’s home energy management solutions as customers electrify their homes and transportation.

- This charger will be rolled-out to all Sunrun markets by year end as an optional add-on with options for bundling with a Sunrun home solar + battery system for significant savings.

- The company announced an exclusive agreement with SPAN, making the company’s smart home electric panels available to residents in Puerto Rico.

- Sunrun’s partnership with Ford to serve as the preferred installer of Ford Intelligent Backup Power has officially launched and the company is taking orders for installation of 80-amp Ford Charge Station Pro and Home Integration System.

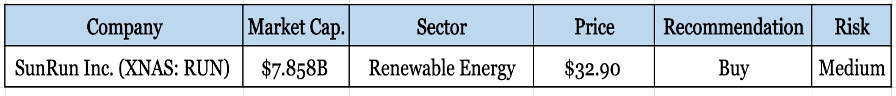

Key Data

| Exchange | Nasdaq (XNAS) | Previous Close | $34.42 | |

| Industry | Clean Energy | Beta | 1.66 | |

| Today’s High/Low | $37.19/$34.07 | Market Cap | $7.53B | |

| 52 Week High/Low | $60.6/$16.8 | P/E Ratio | -51.46 | |

| Share Volume | 2,287,013 | EPS ($) | -0.56 | |

| 1Y Price Target | $47.07 | P/B Ratio | 1.14 |

Second Quarter 2022 Highlights

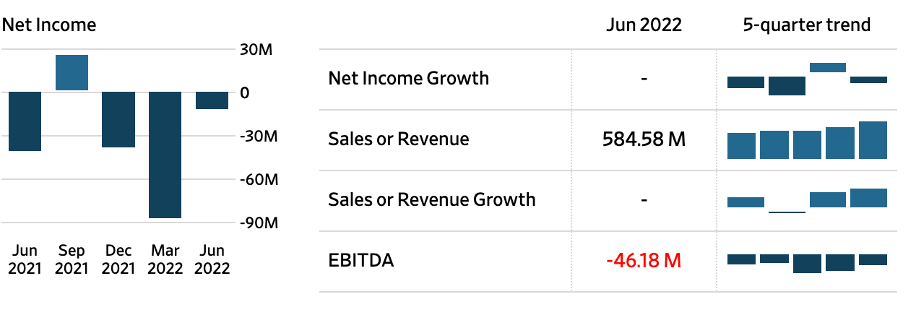

- Total Revenue was $584.6 million in the second quarter of 2022, up $183.4 million, or 46% from the second quarter of 2021.

- Customer agreements and incentives revenue was $259.9 million, an increase of $40.4 million, 18% compared to that of second quarter of 2021.

- Gross Earnings Assets as of June 30, 2022, were $10.8 billion. Net Earning Assets were $4.6 billion, which includes $ 863 million in cash.

- 33% year-over-year growth in solar energy capacity installed in quarter 2.

- Annual recurring revenue of $917 million with average contract life remaining of 17.6 years.

- Customer additions of 34,403 in Q2, bringing total customers to 724,177, or 21% year-over-year growth in customers.

- Solar energy capacity installed was 246.5 megawatts in second quarter of 2022. Solar energy capacity installed for Subscribers was 181.9 megawatts in the Q2.

- Net subscriber value was $7,910 in the second quarter of 2022, an increase from $7,141 in the first quarter of 2021.

- Net loss attributable to common shareholders was $12.4 million, or $0.06 per share in the second quarter of 2022.

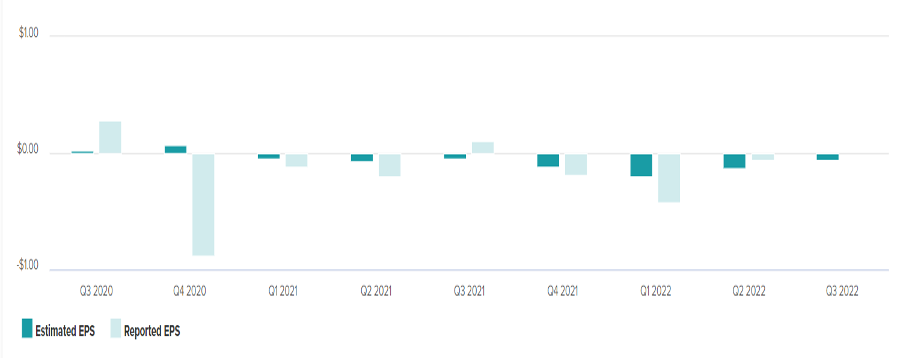

Earnings Per Share

Sunrun’s EPS for the quarter ending June 30,2022 was $-0.06, a 70% decline year-over-year.

Income Statement

The Chart depicts the trailing 5 quarters trend showing the changes in Revenue and Net Income Growth.

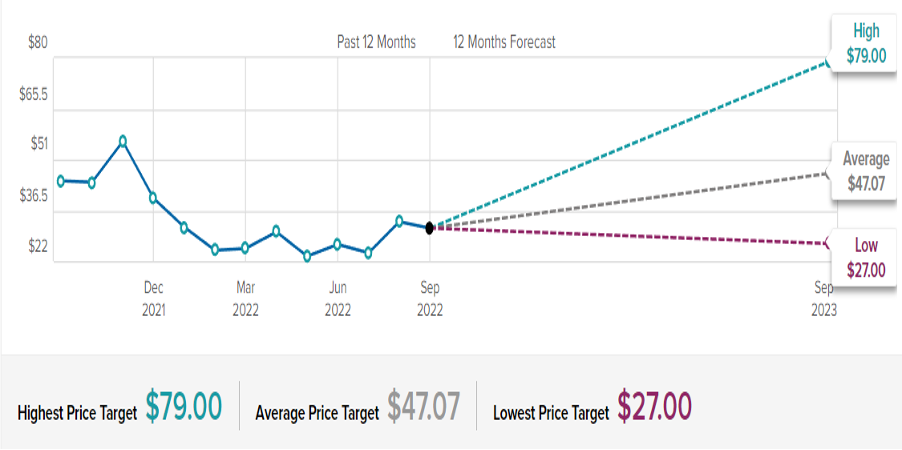

Forecast

Based on 16 Wall Street analysts offering 12-month price targets for Sunrun in the last 3 months. The average price target is $47.07 with a high forecast of $79.00 and a low forecast of $27.00. The average price target represents a 31.44% change from the last price of $35.51.

Risk factors

- RUN’s Return on equity is forecasted to be low in the coming years and analysts are not confident in the firm’s ability to efficiently generate return on equity.

- If we compare the firm’s Revenue Growth Forecast with other solar companies and the industry average, it is analysed that the company’s revenues are forecasted to grow slower (9.55% per year) than the US solar industry average (25%).

Stock Recommendation

Sunrun is the nation’s leading Residential Solar, Storage and Energy Services Company. With the mission to create a planet run by the sun, Sunrun has pioneered the residential solar service. The company believes that America’s energy future starts at home.

By leading the charge on electrifying the home, they are enabling individuals to create, store and control the energy they need to power their homes, their cars, and their communities with clean, renewable energy.

In 2021, the company installed solar systems capable of generating 792 megawatts of power, and in the history of the company, had installed a total of 4.68 gigawatts of power for over 660 thousand customers.

MarketFacts gives a “Buy” rating on the stock at the opening Price of $ 32.90 USD as of September 21st, 2022

| OMP (USD) (September 21st ,2022) | $32.90 |

| Target Price | $45.50 |

| Recommendation | Buy |